Demand grows for a dedicated regulatory framework for NBFCs

Allowing bank loans to NBFC-PSLs will ensure consistent capital flow and empower MSMEs

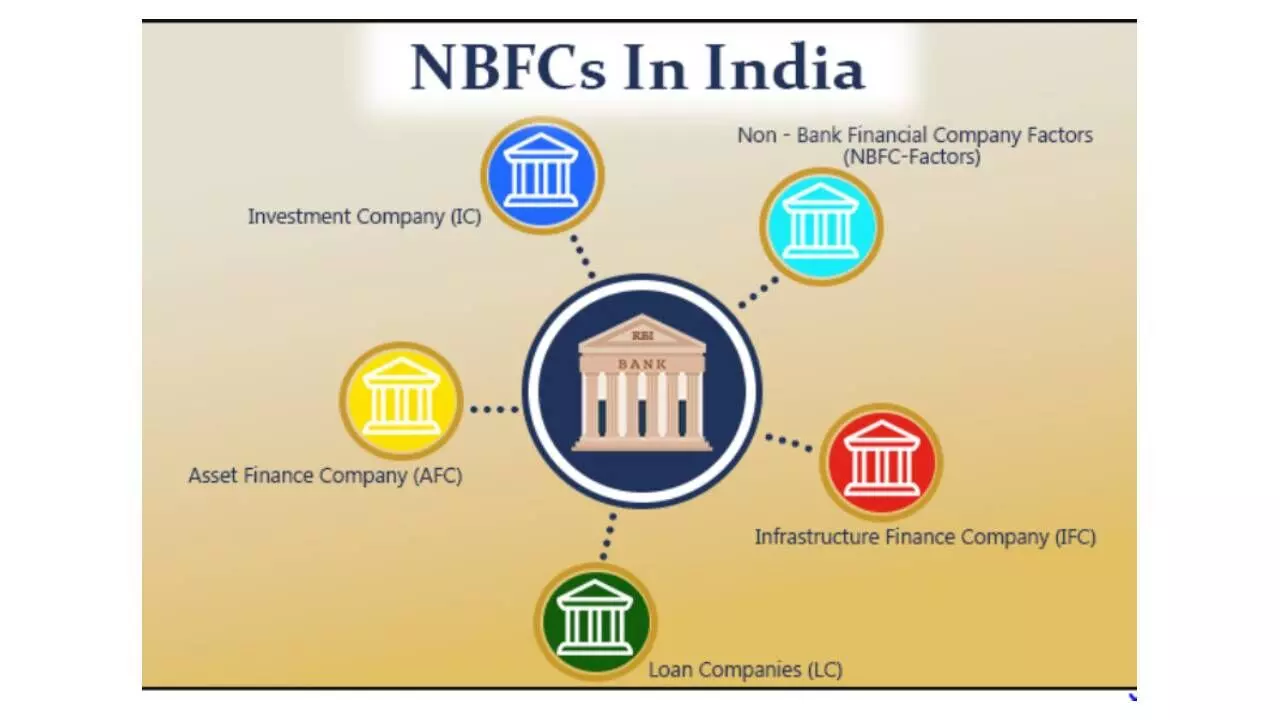

image for illustrative purpose

Establishing a dedicated regulatory framework for NBFC catering to PSL will further enable focused lending to underserved segments, opine many industry experts.

The upcoming Union Budget presents a significant opportunity to strengthen the country’s financial ecosystem and drive inclusive growth.

Talking to Bizz Buzz, Shachindra Nath, founder and Managing Director of UGRO Capital, says, “We urge the government to expand the PSL (Priority Sector Lending) definition so as to include emerging sectors like renewable energy, women-led enterprises, and digital infrastructure, aligning with India’s evolving economic priorities. Establishing a dedicated regulatory framework for NBFC catering to PSL will further enable focused lending to underserved segments.”

Additionally, measures such as concessional refinancing from institutions like SIDBI and NABARD, along with credit guarantee schemes, can lower borrowing costs and mitigate risks, encouraging greater participation from banks and investors. Allowing bank loans to NBFC-PSLs to qualify as PSL will ensure consistent capital flow, empowering MSMEs and other critical sectors to scale operations and contribute to the nation's growth, he said.

By implementing these measures, the budget can pave the way for a robust financial ecosystem, fostering innovation, entrepreneurship, and equitable development across India.

Rajesh Sharma, MD Capri Global Capital says, “As the Union Budget 2025 approaches, the NBFC sector looks forward to policy measures that will bolster its pivotal role in India's economic growth. NBFCs play a crucial role in extending credit to underserved segments like MSMEs, housing, agriculture and renewable energy, contributing to inclusive development. Establishing a dedicated liquidity facility through the Finance Industry Development Council (FIDC), aimed at ensuring affordable credit flow to priority sectors would be beneficial.”

This initiative would support small and mid-sized NBFCs by providing competitive-rate funds, reducing dependency on high-cost borrowing. Empowered with steady capital, NBFCs can effectively meet the credit needs of sectors crucial for job creation, rural development, and sustainable economic growth. Anticipated reforms like reducing the SARFAESI Act's loan threshold to ₹1 lakh, could expedite asset resolution and bolster financial resilience. Additionally, a proposed market-making mechanism could streamline funding access, enhancing the ability to serve priority sectors effectively. Such reforms if implemented, would further help NBFCs to contribute significantly.

Umesh Revankar, Executive Vice Chairman, Shriram Finance says, “We anticipate that the upcoming Union Budget will prioritize infrastructure spending, which will significantly benefit our lending segments, particularly small businesses, contractors, and transporters.” This focus on infrastructure is expected to lead to a surge in demand for steel, cement, and other materials, further driving demand in vehicle finance and other sectors reliant on bulk materials.

This will not only boost economic activity but also create substantial employment opportunities, especially in semi-urban and rural areas. “We foresee new vehicle sales growth in Q4 to be in double digits year-on-year, as we expect government spending on infrastructure to be much higher than previous quarters,” he said.