We will manage high govt's debt binge non-disruptively

The deviation from previous FRBM targets was quite inevitable considering the impact of the Covid pandemic when the government revenues at both the Centre and states crashed for a few months, says RBI governor

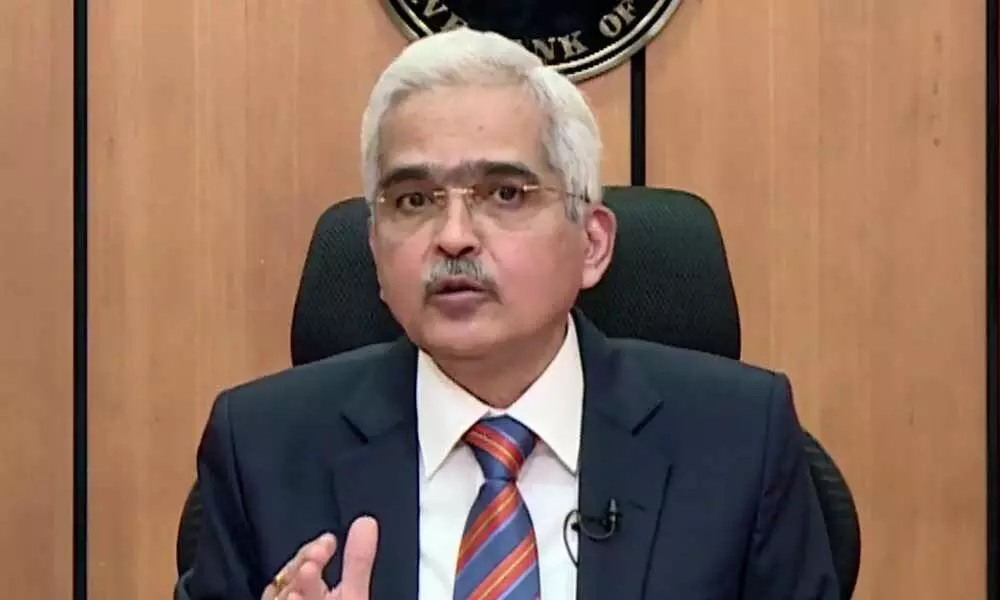

image for illustrative purpose

Mumbai: Governor Shaktikanta Das on Friday exuded confidence of the Reserve Bank being able to manage the high quantum of government borrowings at Rs 12 lakh crore for the next fiscal in a "non-disruptive" manner.

The governor said the extraordinary event of the pandemic has resulted in deviation from the fiscal consolidation road map and declined to comment on what view the rating agencies will be taking on the high fiscal gap at 9.5 per cent in FY21 and 6.8 per cent in FY22. It can be noted that the rating agencies watch the fiscal deficit number as a key indicator of economic strength. Wider fiscal deficits are accompanied with inflation, and usually the RBI also flags such concerns to the government.

Das said the RBI, being the debt manager for the government, did discuss the borrowing with the Ministry of Finance even before the budget. "The deviation from previous FRBM targets was quite inevitable considering the impact of the Covid pandemic when the government revenues at both the Centre and states crashed for a few months," he told reporters. It can be noted that the government was earlier committed to get the fiscal deficit down to 3 per cent in the medium term as per the Fiscal Responsibility and Budget Management (FRBM) Act mandate, and now plans to touch 4.5 per cent by FY26. A wider deficit generally entails bigger borrowing by the government.

Das said as far as the RBI is concerned, what concerns the central bank is the overall government borrowing programme and the debt to GDP ratio. "...we are confident that going forward, in 2021-22 also we will be able to implement government borrowing programme in the most non-disruptive manner. Let there not be any doubt about this," he said, adding that discussions are already underway between the government and the RBI on the same. Asking everybody to look at the RBI's "track record", Das said the RBI ensured lowest borrowing cost in 15 or 16 years and the average maturity was also elongated.