RBI warns banks, NBFCs over extra charges on customers

image for illustrative purpose

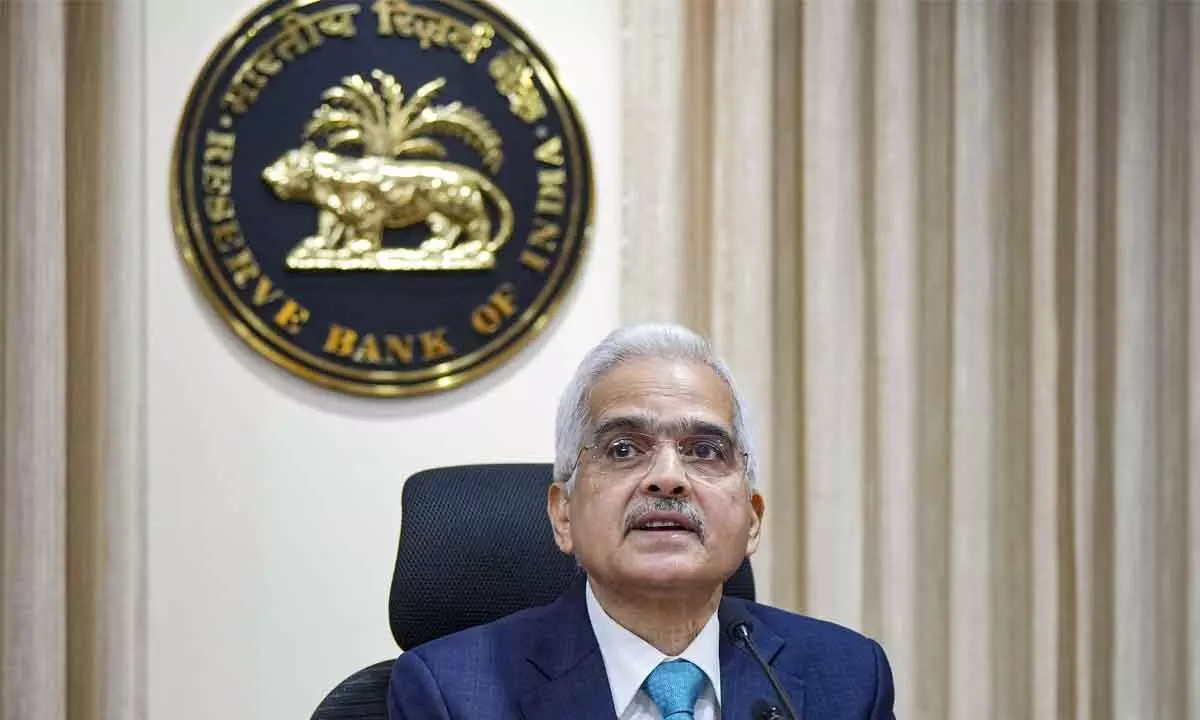

Mumbai: RBI Governor Shaktikanta Das on Friday sent a clear message to banks and NBFCs against charging extra fees and high interest rates on loans to customers. “In general, we have observed that guidelines on Key Facts Statement are followed, but a few banks and NBFCs still charge fees, etc., that are not specified or disclosed in the statement,” Das said at a press conference after the monetary policy committee meeting.

“It has also been observed in some micro-finance institutions and NBFCs that the interest rates on small-value loans are high and appear to be usurious,” the RBI Governor pointed out.

Payments outages due to failure in banks’ systems, not NPCI

Das said each and every instance of an outage is studied by officials concerned at the central bank to analyse what caused it and added that no issue has been found with the National Payments Corporation of India (NPCI) or Unified Payments Interface (UPI) platform run by the body. The regulatory freedom enjoyed by banks and NBFCs in respect of interest rates and charges should be used judiciously to ensure fair and transparent pricing of products and services.