RBI retains repo rate at 6.5%

Not belying the expectations of senior economists, the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) retained the repo rate at 6.50 per cent

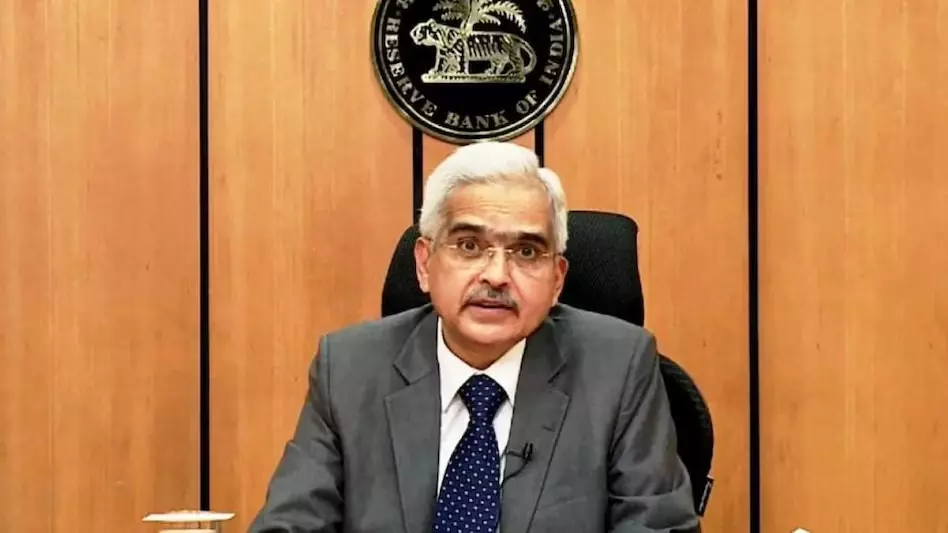

image for illustrative purpose

Chennai, Feb 8: Not belying the expectations of senior economists, the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) retained the repo rate at 6.50 per cent.

The repo rate is the rate at which the RBI lends to the commercial banks.

Announcing the decision of the MPC after its three-day deliberations, RBI Governor Shaktikanta Das said on Thursday that the committee decided to keep the repo rate at 6.5 per cent.

The MPC also decided not to change its stance from 'withdrawal of accomodation'.

The MPC met on February 6-8.

The RBI on Thursday left the repo rate unchanged at 6.5% for the sixth consecutive time as part of its policy to keep inflation in check and at the same time spur growth in the economy.

Five out of six members of the Monetary Policy Committee voted in favour of the rate decision.

Monetary policy must continue to be actively disinflationary, RBI Governor Shaktikanta Das said in a statement.

Das said domestic economic activity remains strong and the growth momentum is expected to continue into the next financial year. The RBI has pegged real GDP growth for 2024-25 at 7%.

He also said that the debt of central and state governments are expected to moderate in years to come.

At the same time, the RBI Governor flagged concern over elevated debt raising serious concern in many countries, which will impact the global financial system.