RBI guv Das asks banks to strengthen governance, risk management

The governor in his opening remarks noted the continued improvement in banks' asset quality, loan provisioning, capital adequacy, and profitability. He urged them to step up efforts against 'mule accounts' and also intensify customer awareness and education initiatives, among other measures, to curb digital frauds

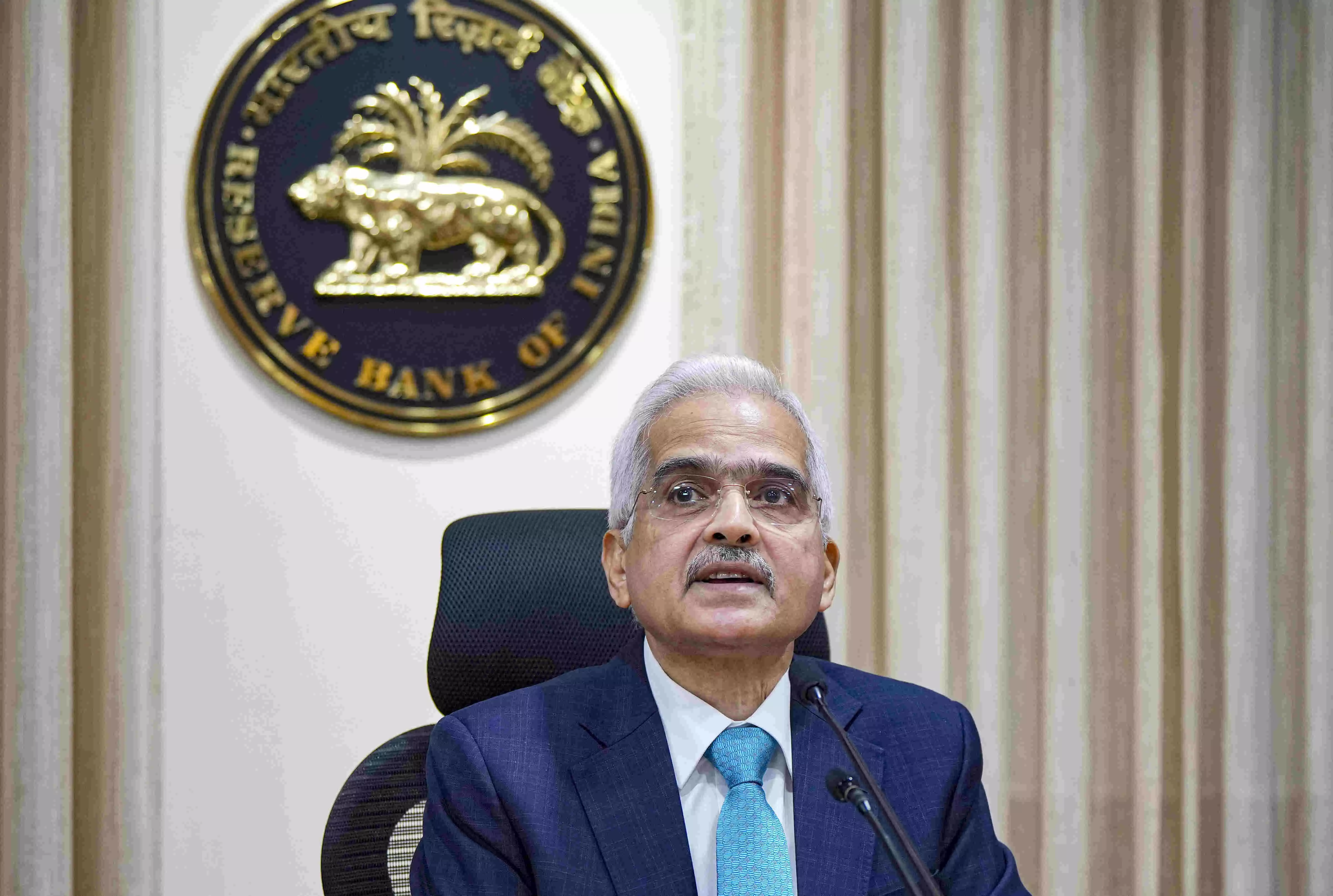

image for illustrative purpose

Mumbai: RBI governor Shaktikanta Das on Wednesday asked banks to further strengthen the governance standards, risk management practices and compliance culture. As part of the Reserve Bank's continuous engagement with the senior management of its regulated entities, Das held meetings with the managing directors (MDs) and chief executive officers (CEOs) of public sector banks and select private banks.

The governor in his opening remarks noted the continued improvement in banks' asset quality, loan provisioning, capital adequacy, and profitability, the RBI said in a statement. "While acknowledging the higher resilience and strength of the banking sector, he highlighted the importance of further strengthening the governance standards, risk management practices and compliance culture in banks," Das said.

Persisting gap between credit and deposit growth; liquidity risk management and ALM-related issues; and trends in unsecured retail lending were among the issues which were discussed at length. Das also emphasised the need for banks to ensure robust cybersecurity controls and effectively manage third-party risks. He urged them to step up efforts against 'mule accounts' and also intensify customer awareness and education initiatives, among other measures, to curb digital frauds, the statement said.

Cybersecurity, third-party risks, and digital frauds; strengthening of assurance functions; credit flows to MSMEs; increasing the usage of Indian Rupee for cross-border transactions; and banks' participation in innovation initiatives of the Reserve Bank too were discussed in detail. The meetings were also attended by deputy governors, M Rajeshwar Rao and Swaminathan J, along with executive directors-in-charge of regulation and supervision functions. The previous such meetings were held on February 14, 2024.