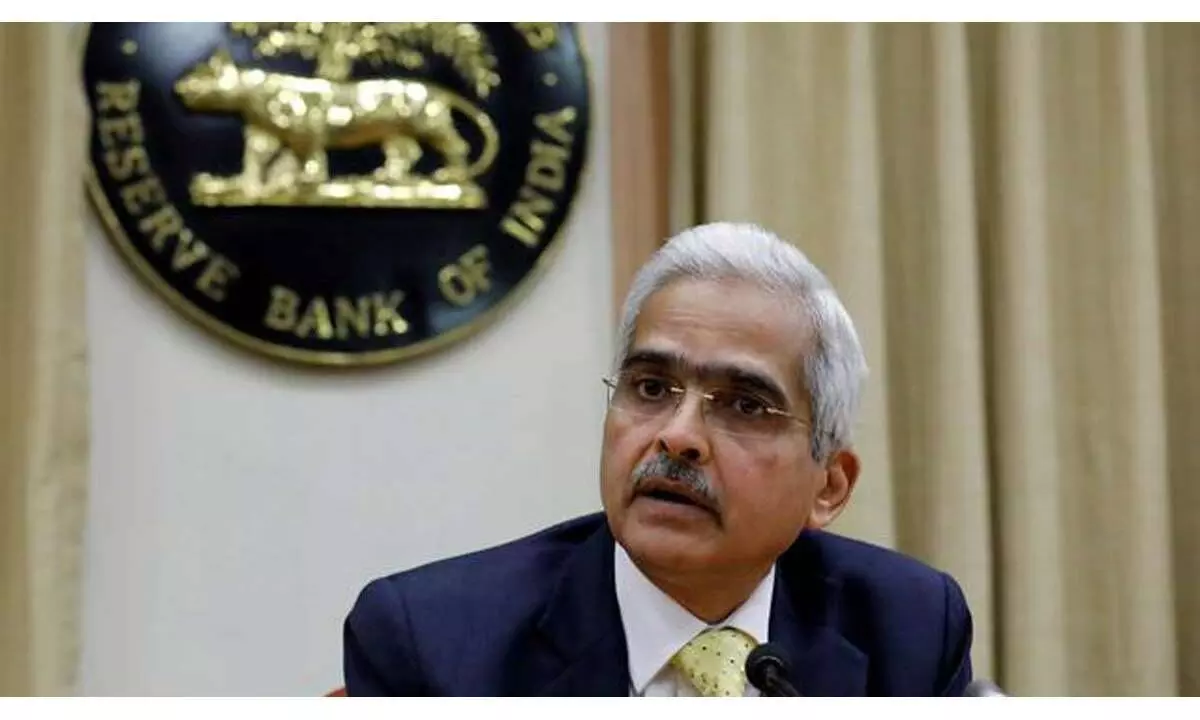

Core inflation continues to remain sticky, says RBI governor Das

Core inflation continues to remain sticky, the RBI governor Shaktikanta Das said this morning while addressing media on conclusion of three0day brainstorming bi-monthly MPC meeting today.

image for illustrative purpose

Mumbai, Dec 08: Core inflation continues to remain sticky, the RBI governor Shaktikanta Das said this morning while addressing media on conclusion of three0day brainstorming bi-monthly MPC meeting today.

The RBI has maintained status quo on its key policy rates. Thus, the repo rate will continue to be at 6.5 per cent.

The RBI governor said that the long-awaited normalcy continues to elude global economy. The Emerging Market economies have remained resilient during the recent bout of volatilities, he said.

RBI left the benchmark policy rate (repo) unchanged in its past four bi-monthly monetary policies. It had last increased the repo rate in February to 6.5 per cent, thus ending the interest rate hike cycle which began in May 2022 in the aftermath of Russia-Ukraine war and subsequent disruptions in the global supply chain resulting in high inflation in the country.

According to RBI governor, “The financial markets remain volatile hence he has said that we are waiting for signals on rates. Indian economy presents picture of resilience, momentum.” The external members on the panel are Shashanka Bhide, Ashima Goyal, and Jayanth R Varma. Besides Governor Das, the other RBI official in MPC is Michael Debabrata Patra (Deputy Governor).