2023 has been a breakthrough year for India’s EV industry

Competition is intensifying with the entry of many players in EV manufacturing

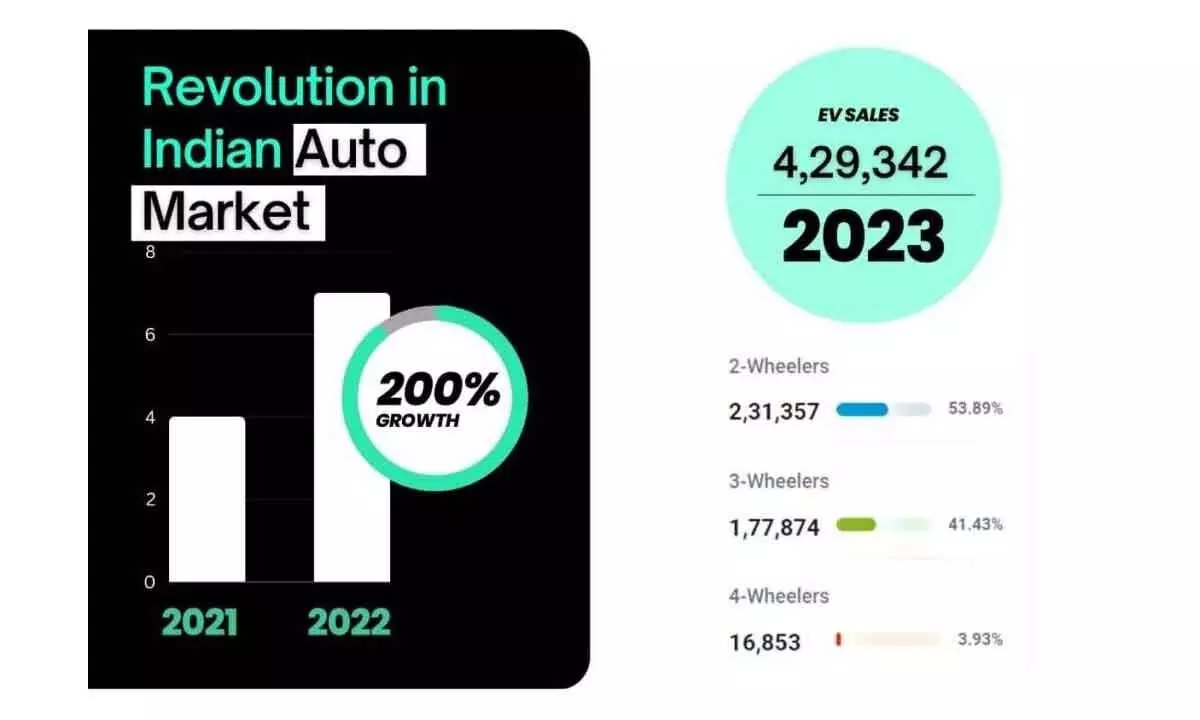

image for illustrative purpose

The future demand trend will be a shift in favour of four-wheelers from two-wheelers as the former will become more affordable. As battery prices continue to fall, EVs will become more affordable and accessible. With continued government support, growing market demand, and expanding infrastructure, India can achieve its target of 30 per cent EV penetration by 2030.

The year 2023 could be termed as electrifying and eventful for the Indian electric vehicle (EV) industry.

While the industry saw good volume growth, it also saw several government actions, mainly in the two-wheeler segment that showed the darker side of the industry.

“Despite unfavourable government actions such as unexpected FAME (Faster Adoption and Manufacturing of Electric Vehicles II (FAME II) subsidy reduction/exhaust of state subsidies/penalties for FAME non-compliance for e2W and lack of payment security mechanism for eBus, EV industry continue to see higher penetration of about 100 basis points (bps) in 2W, 3W and passenger vehicles (PV), though slower-than-expected at start of year,” said Mumuksh Mandlesha, research analyst at Anand Rathi Institutional Equities.

According to Mandlesha, consolidation in the EV two-wheeler segment can be seen as many new and small players affected by penalties levied by the central government for wrongfully claiming subsidies violating local sourcing norms under the FAME II scheme. The Centre issued notices to several electric two-wheeler manufacturers asking them to refund about Rs 500 crore as undue subsidy claims -- using imported components and claiming subsidy as local components. The companies also refunded the cost of chargers to their customers as comes as a part of the vehicle and can’t be charged separately.

“In 2023, the EV industry experienced unprecedented growth and innovation. Our EV has company made rapid strides in battery technology, driving increased range and efficiency. The government incentives worldwide further fuelled consumer adoption, leading to a surge in EV sales,” said Ayush Lohia, CEO, Lohia Auto Industries Ltd.

"Collaborations within the industry intensified, fostering breakthroughs in charging infrastructure. It was a pivotal year for sustainable mobility. We overcame challenges, witnessed heightened public awareness, and played a pivotal role in shaping a cleaner, greener future," he added.

Lohia said the company, which rolls out electric two and three-wheelers, has not received notices from the Central government for FAME II norms violation.

According to H.S. Bhatia, Managing Director, Kelwon Electronics & Appliances, the competition is intensifying with the number of EV manufacturers growing.

Kelwon Electronics is India Licensee partner for South Korean Daewoo and plans to make e-bikes and other products with the latter’s technology. “Also governments around the world are continuously supporting EV adoption with incentives and policies hence in the year 2024 we are expecting the Global EV sales to reach 26 million units in 2024 and 50 million units by 2027,” Bhatia added.

Bhatia said the future demand trend will be a shift in favour of four-wheelers from two-wheelers as the former will become more affordable.

“Also, I’m seeing the growth in the commercial EV segment as businesses are switching to EVs to reduce their operating costs and emissions. Another trend would be growth in the new battery technologies as it has the potential to make EVs even more affordable and practical,” Bhatia said. As battery prices continue to fall, EVs will become more affordable and accessible to Indian consumers. With continued government support, growing market demand, and expanding infrastructure, India can achieve its target of 30 per cent EV penetration by 2030, he added. According to Mandlesha, the EV penetration will continue to improve over the medium to long term due to government thrust and strong global investments happening towards EV technologies which would reduce costs. The electric two wheelers and passenger vehicles can log 40-50 per cent CAGR growth ahead. In fact today in India, all the vehicle makers and ancillaries are more focusing on two/three wheeler and bus segments as they believe it would be the first few segments where penetration grows faster, Mandlesha added. The declining cost of EVs, advancements in technology, and a growing number of manufacturers entering the market contribute to a favourable environment. However, challenges such as limited charging infrastructure and concerns about battery life still exist. Overall, India is making significant strides, and with continued support and infrastructure development, the country is poised for widespread EV adoption, Lohia said.

Queried about the dependence on government subsidies for selling EVs, Bhatia said the industry will eventually become less reliant on government subsidies as battery technology continues to improve, the cost of EVs is expected to come down.

Government subsidies are not needed when 20-25 per cent of the total new vehicle sales are accounted for by EVs. By that time the supply chain would have been established and the economy of scale will bring down prices. By encouraging battery swapping, the cost of the electric vehicle can be brought down and adaptation can happen much faster, Lohia added.

“Scrapping of subsidies could impact companies heavily dependent on it for competitiveness. We foresee the need to recalibrate our pricing strategy, enhance operational efficiency, and intensify marketing efforts to maintain market share,” he remarked.

Citing a study by Indian Institute of Technology, Kanpur (IITK), Suyash Gupta, Director General of Indian Auto LPG Coalition, said drawing on a life cycle and total cost of ownership analysis, the manufacturing, use and scrapping of battery electric vehicles or BEVs causes 15-50 per cent more greenhouse gases than hybrid and conventional engine cars. So, accounting for the manufacturing processes involved, the usage of batteries through their lifetime and their dismantling phases, EVs are responsible for more emissions than conventional and hybrid vehicles, Gupta said. According to him, constraints related to charging infrastructure, development of an indigenous value chain, and the prohibitive costs of transition and consumers’ persisting range anxiety are possibly forcing the government to take a step back.

Apart from the Central government, industry officials want the state governments to lend a strong supporting hand for EV penetration. For a comprehensive 360 degree support, the states can work on all related actions like incentives for manufacturing, retrofitting, setting up of charging stations, special electricity tariff for charging stations, said Bhatia. According to the industry officials, Tamil Nadu, Delhi and Chandigarh have good policies for EVs. One interesting aspect is that the traditional petrol powered two-wheeler makers like TVS Motor and Bajaj are steadily increasing their market share.