Centre forms working group to explore new ways to finance Agri Value Chain

Focus on bill discounting, bridge financing, and risk-hedging to improve liquidity and economic stability

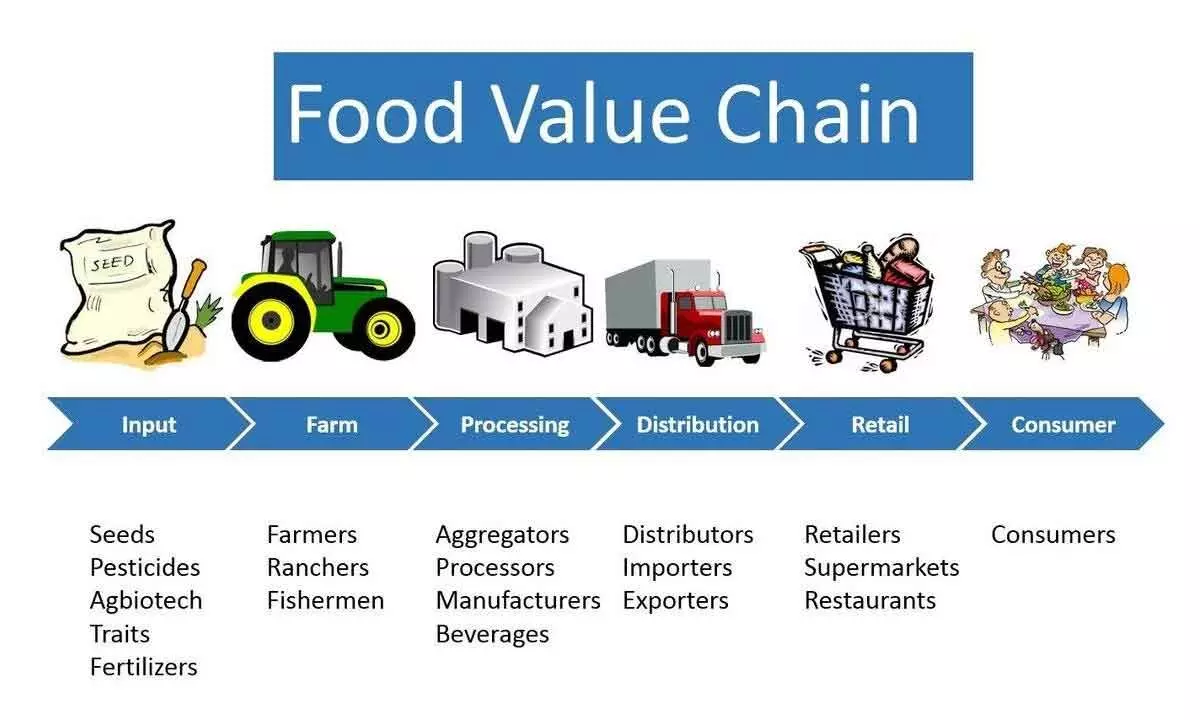

image for illustrative purpose

Senior officials of the Union and state governments, experts, and stakeholders attended the workshop to discuss the dynamics of agricultural financing

The Centre has decided to form a working group to explore innovative banking products for Agri Value Chain Financing to integrate the country’s agriculture sector with global markets and enhance farmers’ income.

The decision was taken following a workshop organised by the Department of Agriculture and Farmers’ Welfare titled ‘Unleashing India’s Agribusiness Potential through Innovative Agri Value Chain Financing’.

Senior officials of the Union and state governments, experts, and stakeholders attended the workshop to discuss the dynamics of agricultural financing.

Agriculture Secretary Manoj Ahuja said, “To develop Agricultural Value Chains (AVCs) more holistically and integrate them with global markets, we must shift our focus from merely addressing supply shortages to meeting market demand.”

Ahuja advocated introducing financial instruments like bill discounting, bridge financing, and risk-hedging to improve liquidity and economic stability.

“Creating an enabling environment with simplified application processes and reduced bureaucratic hurdles is crucial for effectively implementing these instruments,” he added

Vivek Joshi, Secretary, Department of Financial Services, emphasised the critical role of digital financial services in providing timely credit within the Agricultural Value Chain Financing (AVCF) framework, noting a significant increase in agricultural credit availability.

He also highlighted the significant role of NBFCs, fintech, and startups in providing last-mile credit access and specialized financial products, particularly in high-value agricultural markets.

“Our focus is on ensuring seamless and affordable access to credit to support farmers throughout the value chain,” he said.

The workshop focused on creating awareness, facilitating collaboration, exploring solutions, and empowering participants with innovative agricultural finance solutions.

Ajeet Kumar Sahu, Joint Secretary (Credit), DA&FW, highlighted the need for a holistic approach to Agricultural Value Chain Financing, noting that projections indicate agricultural Gross Value Added (GVA) will reach Rs 105 lakh crore by 2030, making value chain financing increasingly vital.