New bull run for digital assets can push Bitcoin beyond the $50,000 mark to a historic high

The regulated Bitcoin ETF in the US is the template to leverage the potential of digital assets

image for illustrative purpose

Ethereum is trying to break the $2700 resistance, which might be successful when Bitcoin dominance decreases from the current 52%. There are approximately 60 days until the Bitcoin halving in April. This can potentially push the cryptocurrency market to new highs

Bitcoin has crossed $50,000 mark for the first time since 2021 in anticipation of the fourth Bitcoin halving in April.

On February 12, Bitcoin (BTC) hit $49,500 marking a new high since December 2021.

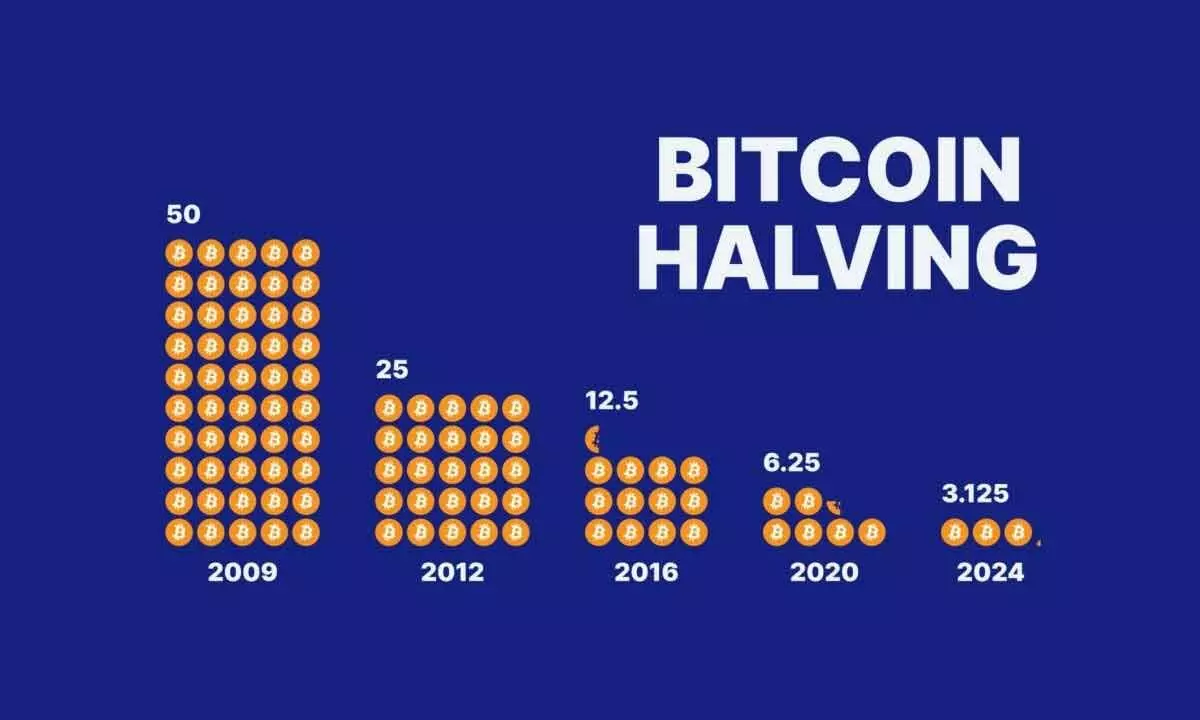

Historically, Bitcoin halvings are basically events that significantly reduce the Bitcoin supply and have always led to positive price action. This time around, there is a heightened expectation from the halving due to the inception of Bitcoin spot ETFs, which have increased the demand for Bitcoin as an investment.

Bitcoin ETFs in the US witnessed net $1.1bn inflows last week, which pushed the total inflows since the approval of Bitcoin spot ETFs to $2.8bn. Overall, digital asset AuM is at its highest level since early 2022 at $59bn as per data released by Coinshares.

Talking to Bizz Buzz, Manhar Garegrat, Country Head- India & Global Partnerships at Liminal Custody Solutions, says, “If this increased demand continues, the halving could mark the beginning of a new bull run for digital assets pushing Bitcoin beyond any earlier all-time highs.”

The presence of a regulated Bitcoin ETF in the US has not only boosted the mass adoption of digital assets but has also acted as a solid template for other developing economies to leverage the true potential of digital assets. This just goes to show that investors are keen to invest, though they continue to sit on the fence as they await a nod from the authorities, he said.

According to Garegrat, “As always, we remain optimistic about the future of digital assets and will continue to develop and participate in safe and regulated pathways for digital asset adoption.”

Rajagopal Menon, Vice-president, WazirX, says, “The positive impact of ETFs is getting reflected as Bitcoin went past $50k for the first time since December 2021. With the rise, it went on to become one of the top 10 most valuable assets. The inflows in Bitcoin ETFs have been unstoppable. Bitcoin ETFs saw $1.1 billion of inflows last week for a cumulative total of $2.8 billion since their launch. The wall of institutional money flowing into ETFs is positively impacting Bitcoin’s price with the halving in April seen as the next major catalyst. Bitcoin’s technical indicators also showcase a ‘buy’ sentiment amidst price increase and an overall bullish sentiment among investors.”

The total crypto market capitalisation has risen to $1.87T. As expected, Bitcoin soared to $50,000 after holding and breaking above the $49,000 support. On the other hand, Ethereum is trying to break the $2700 resistance, which might be successful when Bitcoin dominance decreases from the current 52%. There are approximately 60 days until the Bitcoin halving in April. This can potentially push the cryptocurrency market to new highs.

Shivam Thakral, CEO of BuyUcoin, says, “The macro factors such as the anticipated rate cut by the US Fed and the growing popularity of Bitcoin ETFs will drive the market in the mid to long term. We can expect Bitcoin to retest its all-time high of $69,000 post-halving.”

Ryan Lee, chief analyst at Bitget Research, says,

“The impact of Bitcoin Spot ETFs and market's anticipation for Bitcoin halving in May plays a vital role in the market surge. From January 1 to 10 (Bitcoin ETF approval date), BTC trading volumes grew from $16B to $50B, which is a 300% increase. This is the impact of the approved BTC ETF. However, the effects of Bitcoin halving are yet to factor in.”

Historically Bitcoin Halvings have resulted in driving BTC prices to new ATHs in the preceding year. The first halving occurred in November 2012. Within one year, the price of Bitcoin rose from a high of $13 to $1,152 (in December 2013), and reached its peak 13 months after the halving. The second halving occurred in July 2016, when the price of Bitcoin rose from a high of $664 to $17,760 (December 2017), reaching its peak one year and five months after the halving. The third halving occurred in May 2020, when the price of Bitcoin rose from a high of $9,734 to $67,549 (April-November 2021), reaching its peak one year and six months after the halving.

The fourth halving will occur in April 2024. It is expected that the price of Bitcoin will rise from the highest point in the US dollar and the price is expected to peak one year and five months after the halving. A similar trend has been observed with the previous three halvings with prices increasing over to hit a new BTC price ATH.

As of now, there's no upcoming news that may have a price correlation with Bitcoin except the halving, which may provide returns in the medium to long term. It's also important to take market's psychological levels, such as BTC prices ranging from $50K to the previous ATH, which may cause larger price retracements.