Deviation from path of fiscal consolidation may be transient

Fiscal deficit in FY21 expected to reach close to 6.8% of GDP

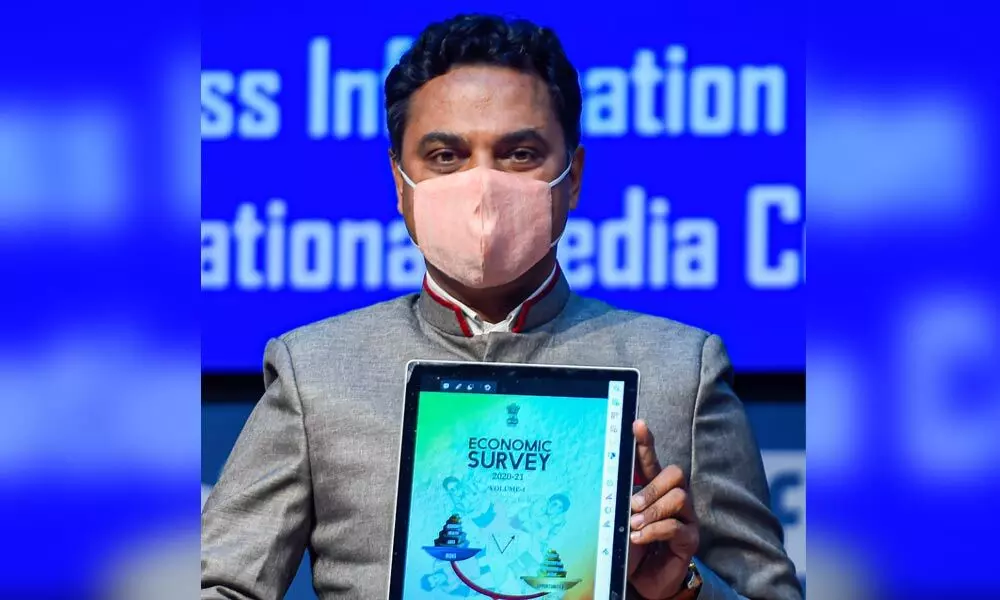

image for illustrative purpose

- Average gross fiscal deficit Budget estimate for States reaches from 2.45 to 4.6% of GSDP post-Covid

New Delhi: Even as pandemic affected year cuts government's revenue while increasing expenditure thereby disbalancing the fiscal situation, the Economic Survey on Friday termed the current development transient with a rebound expected soon on the back of an economic recovery. In the wake of the global pandemic outbreak, the General Government (Centre plus States) is expected to register a fiscal slippage on account of the shortfall in revenue and higher expenditure requirements. "This deviation from the path of fiscal consolidation may however be transient as the fiscal indicators may rebound with the recovery in the economy," the survey said. The central fiscal deficit in FY 21 is expected to reach close to 6.8 per cent of the GDP almost twice the budgeted levels of 3.5 per cent. The country has been missing FRBM targets on deficits year after year while the current situation and persistent slowdown has prevent even adherence to the glide path.

"The calibrated approach adopted by India allows space for maintaining a fiscal impulse the coming year. The growth recovery would facilitate buoyant revenue collections in the medium term, and thereby enable a sustainable fiscal path," the survey noted.

As per the survey, "the average Gross Fiscal Deficit Budget Estimate for States that presented their budgets before the outbreak of Covid-19 was 2.4 per cent of GSDP, while the average for budgets presented post-lockdown was 4.6 per cent of GSDP."

In order to re-orient the focus of the states' fiscal policy on capital expenditure, central government has announced Scheme for Special Assistance to States for Capital Expenditure during FY 2021. Also, one-time special dispensation was allowed to the states by allowing additional borrowings amounting to Rs 0.59 crore for year 2019-20 beyond the State's eligibility.

Additional borrowing limit of up to 2 per cent of Gross State Domestic Product (GSDP) was allowed to the States, of which 1 per cent was conditional on state level reform implementation.

The Economic Survey highlighted that fiscal policy response of the Government has been a combination of demand and supply side policies under the ambit of 'AatmaNirbhar Bharat' to cushion against the pandemic shock, and subsequently fuel the economic recovery. "The fiscal policy response of the government to the pandemic was distinct from other countries. Unlike many other countries that chose a front-loaded grand stimulus package for revival of the economy, government adopted a step-by-step approach," the survey said.

The Economic Survey highlighted that the government carried out world's largest food programme, direct transfers to Jan Dhan accounts, government guarantees for credit, etc. The focus of the fiscal stimulus was widened to boost the domestic demand such as ramping up of capital expenditure, Production Linked Incentives and other schemes to revive consumption demand. The Pre Budget survey noted that "the Fiscal Deficit for 2019-20 Provisional Actuals stood at 4.6 per cent of GDP, which was 0.8 percentage points higher than the Fiscal Deficit envisaged in 2019-20 RE, and 1.2 percentage points higher than fiscal deficit in 2018-19."

The effective Revenue Deficit increased by 1 per cent of GDP to reach 2.4 percent of GDP in 2019-20 PA relative to 2018-19. The survey stated that corporate and personal income tax have come down in 2019-20 mainly due to moderation in growth and implementation of structural reforms like corporate tax rate cut.