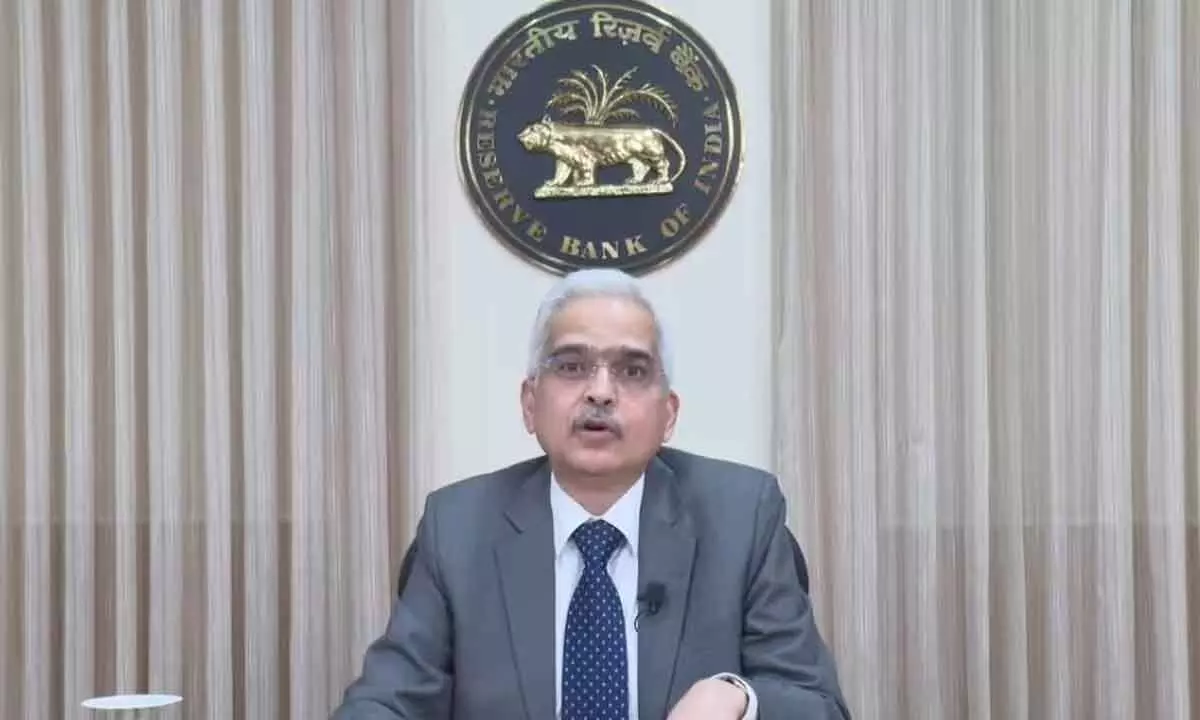

RBI Guv Hints At No Rate Cut In Dec

Says he doesn’t rush to declare that the economy is slowing down as data coming in is mixed

RBI Guv Hints At No Rate Cut In Dec

A change in stance doesn’t mean there will be a rate cut in the very next monetary policy meeting. There were still significant upside risks to inflation and a rate cut at this stage would be very risky - Shaktikanta Das, Governor, RBI

Mumbai: Reserve Bank of India Governor Shaktikanta Das on Wednesday said that although the central bank had shifted towards a softer neutral monetary policy stance to spur growth, this did not mean that an interest rate cut would happen immediately. The next meeting of the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) is scheduled for December 2024.

Addressing a media event here, the RBI Governor said: “A change in stance doesn’t mean there will be a rate cut in the very next monetary policy meeting.”

He said there were still significant upside risks to inflation and “a rate cut at this stage would be very risky”.

“Data which is coming in is mixed, but the positives outweigh the negatives and by and large underlying activities remain strong,” Das said. It can be noted that many analysts have been voicing concerns about growth, especially after official data showed growth slowing to a 15-quarter low of 6.7 per cent in the first quarter of FY25. The RBI, however, has been holding onto its estimate of 7.2 per cent real GDP growth for FY25, even as some expect it to be lower than 7 per cent. Das said the RBI tracks over 70 high-speed indicators to arrive at its estimates and described both the positive factors pushing the number and the negatives pulling it down.

The RBI, at its monetary policy review, kept interest rates unchanged for the 10th straight meeting, but switched its monetary policy stance to ‘neutral’ from ‘withdrawal of accommodation’.

This had led to speculation that the way had been paved for an interest rate cut. Das said that easing measures would only be considered once inflation sustainably falls to the RBI’s four per cent target on a durable basis.

Inflation rose from 3.65 per cent in August to 5.49 per cent in September on the back of rising food prices. At the same time, Das is bullish on the outlook for the Indian economy.

“I would not rush to declare that the economy is slowing down. The data coming in is mixed, but the positives outweigh the negatives. By and large, underlying economic activity remains strong,” he remarked.