Draw a line between empowerment, welfare and freebies for sustainable growth

If found absolutely necessary, freebies should be on means-tested basis to optimise resource utilisation

image for illustrative purpose

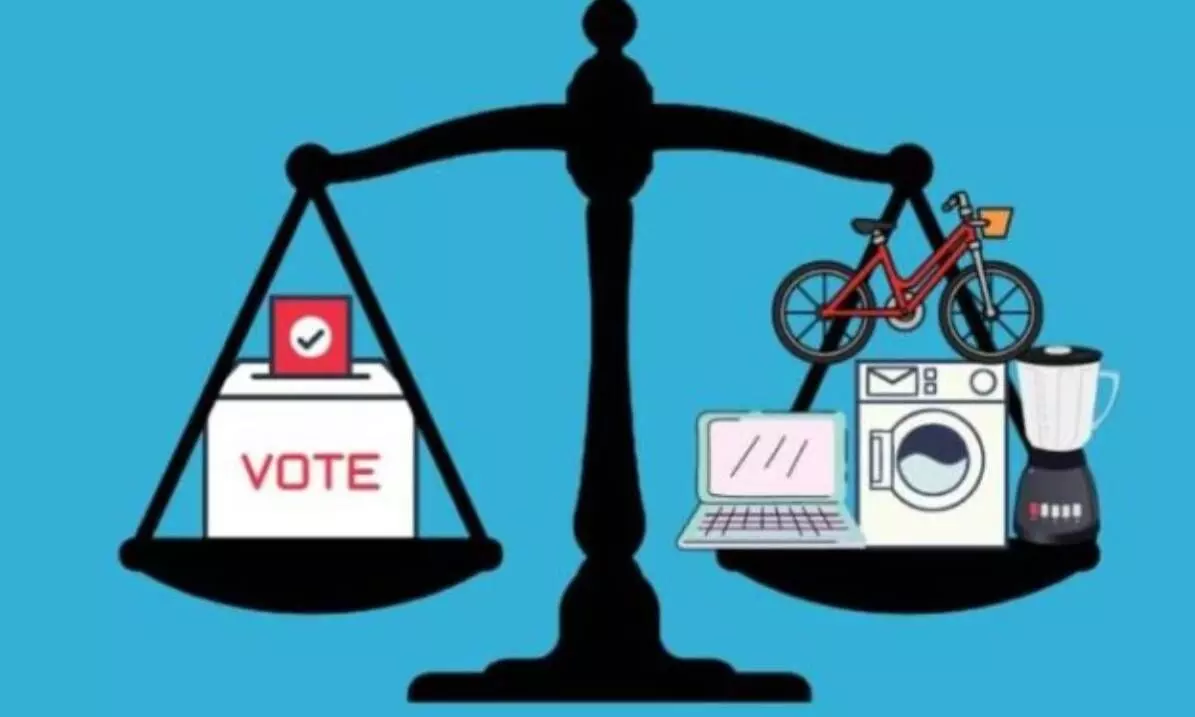

India is a welfare state and so welfare measures are important for inclusive growth. The government schemes to empower people are also crucial for sustainable economic and social development. Amid these, freebies have occupied a great space in India’s political arena as they are endeavoured to reap electoral benefits by political parties of every hue. The time has come to differentiate between them, otherwise competitive politics will reach a point where the cost of economics will jeopardise long-term fiscal discipline.

The differentiation is not easy with various possible connotations and interpretation but may be made objective.

In my view, welfare measures are those initiatives which are revenue expenditure by nature but important for inclusive growth as some sections of the people who have been left behind deserve to be brought to the economic mainstream by addressing their basic needs and priorities. Schemes like PM Awaas Yojana, Atal Pension Yojana, PM Suraksha Bima Yojana and PM Jeevan Jyoti Bima Yojana may be classified as welfare measures.

Empowerment schemes are those initiatives which are capital investments or revenue expenditure but with the objective of creating a long-term sustainable economic paradigm by economically and socially empowering people. Schemes such as PM Stand Up India Yojana, PM Kaushal Vikas Yojana, Start Up India Yojana, Make In India come under this category.

Freebies are transactional in approach. They are not meant to only benefit the needy sections but are extended to even those, who can easily afford them on their own.

This is nothing but economic kickbacks aimed at deriving political advantage, especially during elections. Sometimes these freebies are defended ‘as tax incentives’ to the taxpayers and companies. Some of the freebies such as bicycle to a girl- child or meals at school may build social benefit, including the targetted population if efficiently planned and properly implemented. However, one should remember that there are other productive ways to achieve the goals which are generally used to mask the intended political advantage.

There is no gainsaying that freebies involve huge fiscal costs and inefficiencies by distorting prices and misallocating resources.

According to the RBI report on “State Finances: A Risk Analysis”, provision of free electricity, free water, free public transportation, waiver of pending utility bills and farm loan waivers are often regarded as freebies, which potentially undermine credit culture, distort prices through cross-subsidisation eroding incentives for private investment, and disincentivise work at the current wage rate leading to a drop in labour force participation.

Freebies announced by States in 2022-23 in percentages of Revenue Receipts and Own Tax Revenue is given below for a quick comparison.

Andhra Pradesh, Jharkhand, Madhya Pradesh, Punjab and West Bengal have incurred more than 20% of their own tax revenue for freebies; the number as % of their revenue receipts in freebies is also alarming. There is a need to control such unproductive and inefficient use of public money for one’s political advantage.

The State Bank of India has also suggested that a Supreme Court panel should define limits on how much states can spend on such schemes.

Recently, in the run-up to elections, the Congress party had given five major guarantees —The total cost of all the freebies as per a newspaper report would be around Rs 65,082 crore a year. In its report, CAG (2022) reported that the Delhi government spent Rs 3,593 crore on subsidies in 2019-20. This was an annualised increase of 14% from 2015-16 (Rs 1,868 crore). In 2023-24, the government has allocated Rs 3,250 crore towards power subsidies and Rs 600 crore towards water subsidies.

These freebies manifest a lack of long-term vision and always displayed as an urgent move towards public welfare. In case the implementation of such support is required, it should be strictly on means-tested basis to optimise resource utilisation.

Many a time, freebies are at the cost of capital outlay. We need to strike a balance between important and urgent for an empowered and vibrant Bharat.

(The writer is Fellow of Institute of Actuaries of India, Member of Investor Education and Protection Fund (IEPF) Authority, Government of India. The views expressed are personal)