Bolstering Our Defence Capabilities Is The Best Bet To Counter Threats From China And Pakistan

Growth of exports will generate revenue that is paramount to meet the country’s immediate defence requirements

Bolstering Our Defence Capabilities Is The Best Bet To Counter Threats From China And Pakistan

JVs created by the likes of Airbus, BAE Systems, Boeing, Dassault, Israel Aerospace Industries, Lockheed Martin, Saab, Safran, Military Industrial Consortium NPO Machinostroyeania (Russia) have brought in investments, technology, high-end manufacturing skills, access to testing facilities and their established markets

One of DRDO’s most notable contributions to India’s defence exports is the BrahMos supersonic cruise missile. Jointly developed with Russia, the BrahMos missile is one of the fastest cruise missiles globally, with a range of about 290 km. Its versatility, with the capability to be launched from land, sea, and air, has made it a highly sought-after weapon system internationally.

In addition to missile systems, DRDO has also contributed to the defence exports through radars, electronic warfare systems, unmanned aerial vehicles (UAVs), armoured vehicles and naval systems.

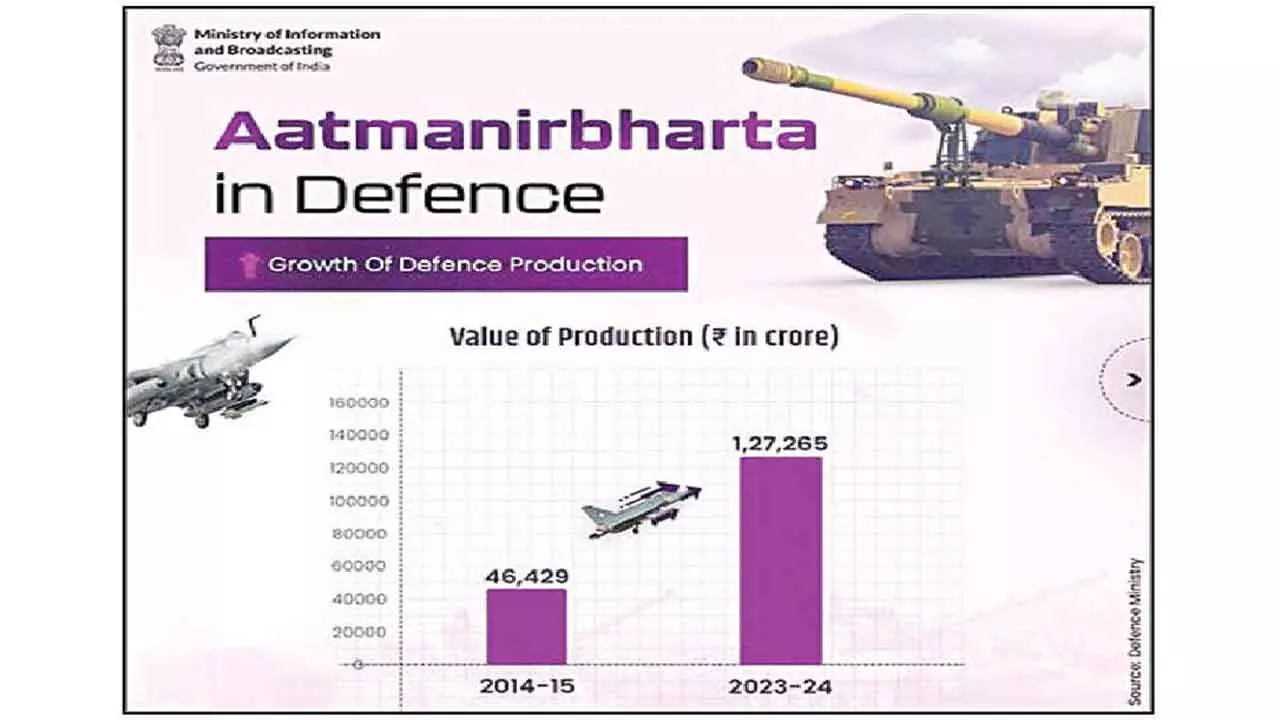

The growth of India’s exports will help generate revenue that is much needed to meet the immediate defence requirements. The defence exports have reached an all-time high, surging from ₹686 crore in FY 2013-14 to ₹21,083 crore in FY 2023-24, reflecting a remarkable increase of over 30 times in export value over the past decade.

This achievement is driven by effective policy reforms, initiatives, and improvements in the ease of doing business implemented by the government, all aimed at attaining self-reliance in defence. Notably, defence exports also experienced a substantial growth of 32.5% over the previous fiscal year, rising from ₹15,920 crore.

India's export portfolio boasts of a diverse range of advanced defence equipment, including bulletproof jackets and helmets, Dornier (Do-228) aircraft, Chetak helicopters, fast interceptor boats, and lightweight torpedoes. A noteworthy highlight is the inclusion of 'Made in Bihar' boots in the Russian army's equipment, marking a significant milestone for Indian products in the global defence market, which also exemplify the country’s high manufacturing standards.

In its report KPMG defines India’s exports strategies to bolster defence capabilities for the future. Defence exports broadly fall under four different categories. The first category constitutes complete platforms/ systems, developed and manufactured primarily for domestic use. Such indigenous acquisition results in a direct reduction of imports. Their exports lead to achieving economies of scale, besides fostering strategic bonds with select countries for at least three to four decades, the service life of these systems. As of date, such systems are primarily manufactured either by DPSUs or select private arms majors in India. This is because of being capital and technology-intensive, and the global markets being hugely contested by established players.

In the journey to develop major platforms, an entire system of tier 2/3/4 MSME vendors gets created. Besides supporting the design and manufacture of various major platforms, these industries also become affordable sources of sub-systems, components, and spares for various global arms manufacturers.

Some of these smaller industries have also carved a place for themselves in the field of less capital-intensive defence products like individual protective gear, weapon sights, night vision devices, simulators, micro drones, camouflage, deception equipment etc. With the promotion policies of the government for MSMEs, their global visibility and reach have improved, substantially. They are now able to plug into the supply chains of major OEMs in the US and NATO members. These constitute the second category of defence exports.

The third category is the defence exports from the joint ventures (JVs) created by foreign OEMs in India and the offset partners identified by them to enable the discharge of contractual offset obligations. Some of our defence exports emanate from such industries and as part of this obligation. JVs created in India by the likes of Airbus, BAE Systems, Boeing, Dassault, Israel Aerospace Industries (IAI), Lockheed Martin, Saab, Safran, Military Industrial Consortium NPO Machinostroyeania (Russia) have brought in investments, technology, high-end manufacturing skills, access to testing facilities and their established markets.

However, access to their IPRs remains restricted, constraining stand-alone exports and indigenous spiral development.

The fourth, yet emerging category, is of budding innovators in the field of niche technologies like satellites, launch vehicles, swarm drones, anti-drone systems, AI, autonomous vehicles and underwater domain awareness.

These innovators are laying a bridge with advanced countries for accelerated development of technology-enabled systems. They are entering a ‘less contested’ segment of defence exports with immense potential to get the country maximum value in capability development and economic growth.

In the scheme of promoting Indian defence exports, each of these categories is equally important but requires a different approach towards promotion. It is imperative to remain cognizant that sales and exports related to offset discharge are temporary. The endeavour must be on integration of offset partners into larger supply chains. There is also a requirement for greater impetus to be accorded to indigenise larger systems/platforms to directly enhance exports and reduce imports.

The IPRs for these must rest within the country. The as yet inadequately explored provisions of co-development with strategic partners also need to be leveraged for long-term benefits.