IndiGo is now the world's third-largest airline by market cap

IndiGo, the operator of the renowned IndiGo airline in India, has achieved a significant milestone as its shares soared to record highs, making it the world's third-largest airline by market capitalization.

image for illustrative purpose

IndiGo, the operator of the renowned IndiGo airline in India, has achieved a significant milestone as its shares soared to record highs, making it the world's third-largest airline by market capitalization. On April 10, its shares surged by 5 percent to Rs 3,801 apiece during afternoon trading, marking the fourth consecutive day of gains.

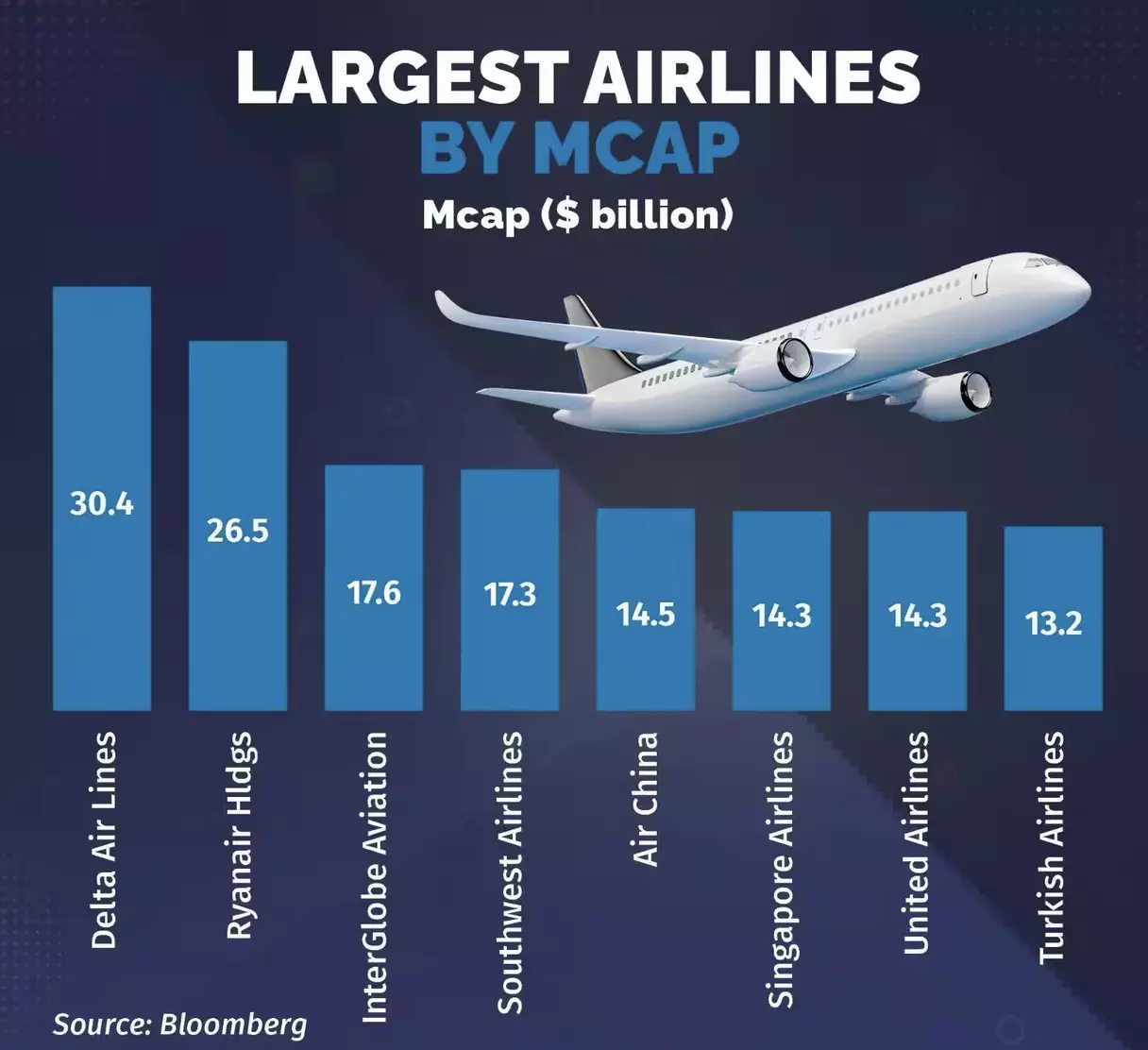

This remarkable performance has propelled IndiGo's total market value to over Rs 1,46,000 crore ($17.5 billion), according to Bloomberg data. Such an impressive feat has enabled IndiGo to surpass United Airlines and secure the third position globally in terms of market capitalization.

This achievement comes on the heels of a series of positive developments for IndiGo. In December 2023, it surpassed United Airlines to become the sixth-largest airline in the world. Notably, Delta Air and Ryanair Holdings currently hold the top two positions with market capitalizations of $30.4 billion and $26.5 billion, respectively.

The surge in IndiGo's share price has been phenomenal, with a massive 99.7 percent increase over the past year. This bullish trend has been further fueled by strong growth forecasts provided by multiple brokerages following an analysts' meet in late March. UBS, for instance, reiterated its "buy" call on the stock, citing IndiGo's robust growth prospects, efficient cost structure, and operational excellence.

Similarly, ICICI Securities has expressed a bullish outlook on InterGlobe Aviation, highlighting favorable demand-supply dynamics and the company's strong position across various metrics, including its balance sheet strength and market share. The brokerage has assigned a price target of Rs 4,009, anticipating continued growth for the low-cost carrier.

IndiGo's performance in meeting its FY24 targets across all fronts has instilled confidence in its ability to achieve early double-digit growth in capacity and passengers for FY25. This optimism has translated into a positive investor sentiment, reflected in the stock's current trading price of Rs 3,798, up 4.5 percent from the previous close on the NSE.

Despite these promising developments, it's essential for investors to exercise caution and consult certified experts before making any investment decisions, as noted by Moneycontrol.com.