Gold loan companies see increased demand as Covid economic downturn spurred borrowing

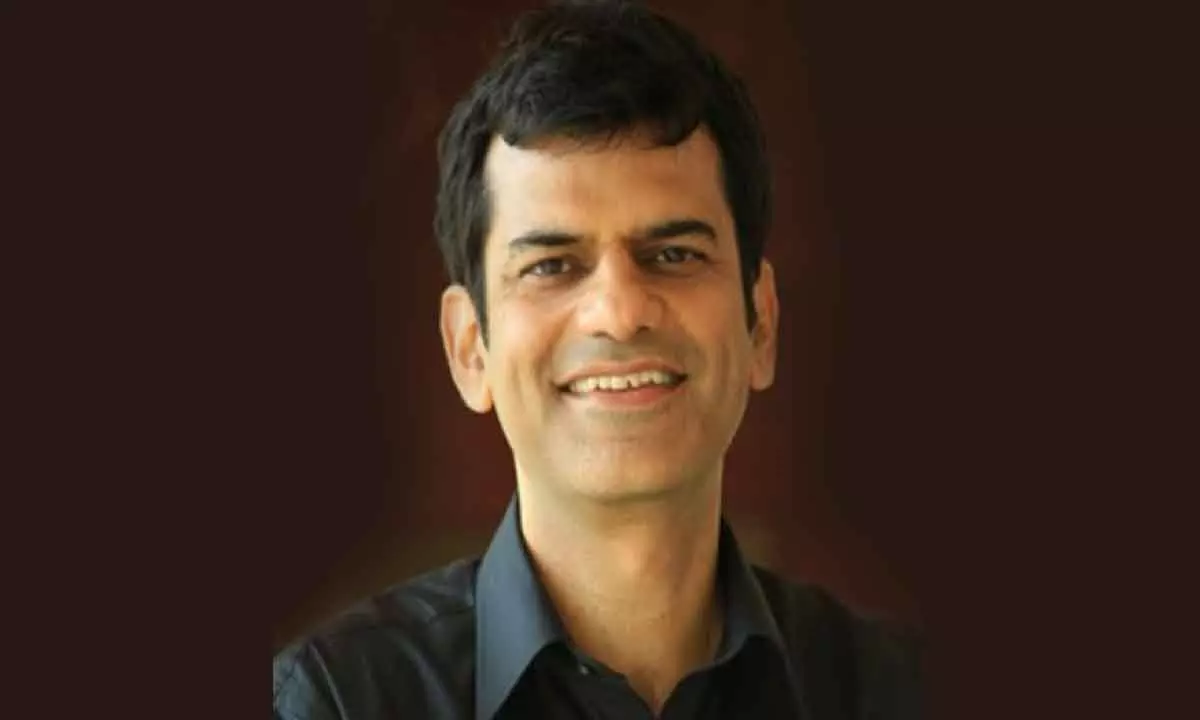

A lot of gold lending happens through informal channels, but the share of the organized market is increasing, says Radian Finserv founder Sumit Sharma

image for illustrative purpose

Sumit Sharma, founder of Radian Finserv, is redefining the gold loan industry in India. With a hybrid approach that emphasizes physical presence and technology, Radian Finserv is making gold loans more accessible and affordable for underserved communities. In an exclusive interview with Bizz Buzz, Sharma discusses the dynamics of the gold loan market in India, the volatility of the market, the emerging trend of gold bonds, and his company's plans for the future

What can you tell us about the dynamics of the gold loan market in India?

In India, we are sitting on a gold reserve of 25,000-28,000 tonnes, making it the largest gold reserve globally. This amount surpasses the sovereign gold holdings of any country, including the United States which has the biggest sovereign gold reserves. The organized gold loan market in India stands at approximately Rs 6 lakh crore, and it is experiencing a steady growth rate of about 15 per cent annually. The major market share is dominated by a select few incumbents such as Muthoot Finance, Manappuram Finance, and public sector banks, who offer gold loan services backed by years of experience. Additionally, there is a group of emerging digital players who are gradually making their presence felt, by offering customer doorstep services, and using digital channels for customer acquisition.

At Radian, we've adopted a hybrid approach, or what we like to call a ‘physital’ model. We emphasize physical presence in our sourcing strategy, which, based on our experience, we believe is the right approach. I must admit that we started by thinking that we would have a digital only customer acquisition platform, but quickly pivoted to setting up physical distribution, based primarily on customer feedback. Our primary focus is on establishing a robust distribution network, primarily in Tier 2-3 cities, and then incorporating technology, rather than going purely digital. This allows us better customer connect. Currently, we are self-funded, having raised a modest amount from friends and family. We haven't sought institutional funding as yet.

What kind of volatility you have seen in the gold loan market?

The long-term trend of the gold loan market shows positive signs. What the regulator has done is put a cap or loan to value (LTV) ratio of 75 per cent. This provides a sufficient cushion between principal and interest amounts even if gold prices dip. The chances of prices going drastically downwards are rare. RBI has taken various steps to bring the organised gold loan market under control including the auction process being completely standardized. We have seen historically delinquency levels at sub 0.3 per cent. A lot of gold lending happens through informal channels, but the share of the organized market is increasing, and will continue to do so, especially with the advent of technology resulting in easier reach. During Covid-19 we saw the prices of gold rising significantly given economic downturn and this helped gold loan companies.

Are gold loans used as a last resort?

Well, yes and no. Gold loans have often been seen as a matter of last resort, but we are seeing increasing signs of this changing, and customers use gold for monetising given its intrinsic value. For instance, we fund a lot of farmers who pledge gold during the sowing cycle and buy further gold after the crop harvest. This has been a pattern for many rural households given the affinity for gold involved. In certain States, we have found that gold loan is increasingly used for planned expenditures rather than just a matter of last resort. This is a positive trend that will form a crucial linkage in taking credit lines against gold to the masses. We draw comfort from the observed patterns and in our bit to create further awareness, came up with a marketing campaign ‘Gold Loan Is Smart’.

How do you perceive the emerging trend of gold bonds?

Commodity ETFs have gained popularity giving an option to invest in gold bonds. At the end of the day, it is an investment opposite to what people relish when they buy gold which can be felt and touched. If we look at overall penetration, the fondness for keeping physical gold is quite high, and given the strong affinity for gold in India, and the fact that gold buying is more than just a financial investment, the physical buying of gold is unlikely to be drastically affected.

What are the prevailing interest rates in the gold loan industry?

Radian takes a thoughtful approach to interest rates, with a focus on sustainable growth. Typically, our customers come from low to mid-income households. Interest rates in this sector can vary, ranging from 10-11 per cent to 22 per cent. However, we have made a conscious decision not to engage in an interest rate war, as we plan not to work blindly towards enhancing our loan book, irrespective of sustainability. Many companies offer subsidized rates, sometimes even lower than their cost of funds, in a bid to expand their customer base. We are committed to financial stability ensuring responsible lending practices whilst providing essential financial services to the target market. We also do not engage in punitive ‘jumping rates’ that start with a low rate of interest for customers, but increase rapidly in case of a missed payment.

Where do you foresee Radian Finserv in the next five years?

In the next five years, we aim to achieve Assets under management (AUM) in the range of Rs 3,000 crore. This goal is quite attainable, given the growth trajectory we are currently on. At the moment, we are proceeding cautiously as we are operating on a bootstrapped model, with limited financial resources. However, we anticipate our next round of funding to be in the vicinity of $15 million dollars or over Rs 120 crore, comprising investments from venture capitalists (VCs), family offices (FO), and other strategic partners. Over time we will raise more funds to help fuel expansion, and increase the rate of growth. To this point, we have raised funding in the range of Rs 32 crore, including the founders’ contribution and from friends and family. Our strategic vision and calculated approach to growth have positioned us for success without being reckless.

Where will you use the funding?

Our current trajectory sets up well for tempered growth and helps us move to break even and profitability next year. The additional funds will be used to help us grow at a faster pace, and establish us a large player in the industry. We’ll use the funds for three primary activities. Firstly, to increase our geographic presence; we are in five States currently and wish to expand to 3-4 more States in the medium term. We want to become denser and increase branch productivity to scale up our operations. Secondly, we would invest at a faster pace in building technology and automation, and have plans on bringing in innovative products with the aid of technology and AI, and building loan offerings to customers based on their creditworthiness determined by algorithms. Thirdly, we would use the funds to build our team. We have a great team, but also one that is quite stretched, given the scale of our ambition, and the opportunity.