Form 16 | How to Download Form 16 from the Income Tax Portal

If you are a salaried employee, you may be familiar with Form 16 when filing income taxes. To ensure tax compliance, both employers and employees must understand the Form 16 components, eligibility, and importance.

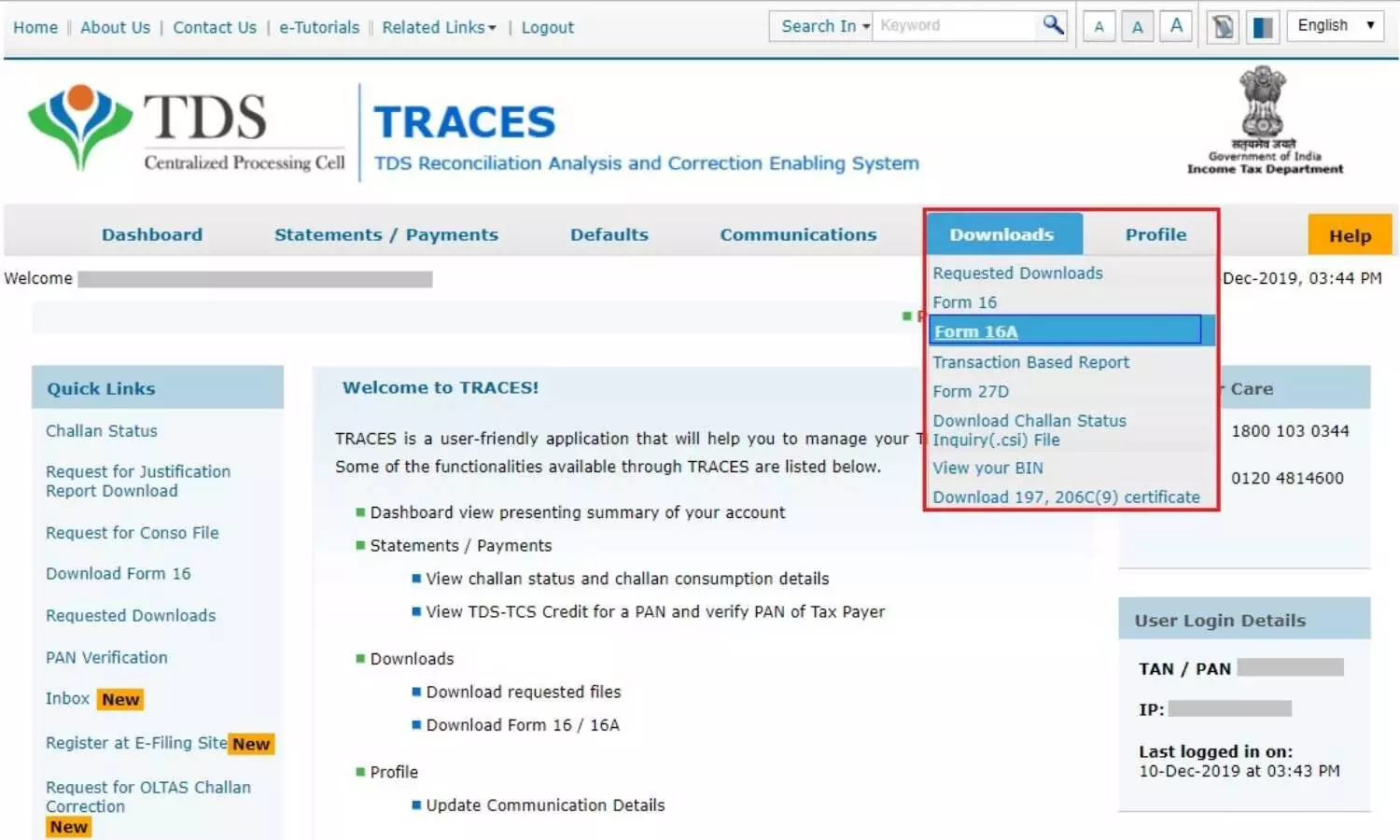

image for illustrative purpose

What exactly is Form 16?

Form 16, which is a TDS certificate, displays the salary earned and the TDS that has been deducted from it. After the conclusion of the financial year in which the income was earned, the employer issues it before June 15th of each year. Please bear in mind that Form 16 should be received from all employers you have served. Form 16 consists of two parts:

Part A

Part A of Form 16 contains information regarding the employer's PAN and TAN, as well as the quarterly TDS deducted and deposited.

This section of Form 16 can be generated and downloaded by an employer via the TRACES portal (https://www.tdscpc.gov.in/app/login.xhtml ). The certificate's contents should be verified by the employer prior to its issuance.

The components in Part A-

i) Name and address of the employer

ii) TAN and PAN of employer

iii) PAN of the employee

iv) Quarterly summary of total salary payments for the financial year

v) Summary of tax deducted and deposited quarterly

Part B

The Annexure to Part A is Part B of Form 16. Part B is to be prepared by the employer for its employees and contains the details of the salary breakdown and deductions that have been approved under Chapter VI-A.

If you change your employment within a single financial year, you are required to obtain Form 16 from both employers.

The components in Part B-

i) Detailed breakdown of salary

ii)Detailed breakup of exempted allowances under Section 10

Deductions allowed under the Income Tax Act (under chapter VIA):

i) Life insurance premium, contribution to PPF, etc., under Section 80C

ii) Pension funds under Section 80CCC

iii) Employee’s contribution to a pension scheme under Section 80CCD

iv) Taxpayer’s self-contribution to a notified pension scheme under Section 80CCD

v) Employer’s contribution to a pension scheme under Section 80CCD

vi) Health insurance premium paid under Section 80D

vii) Interest paid on loan taken for higher education under Section 80E

viii) Donations made under Section 80G

ix) Interest income on savings account under Section 80TTA.

x) Tax calculated, surcharge, education and health cess charged, relief under section 89.

Form 16, Form 16A, and Form 16B differences

a) The employer issues Form 16 as a TDS certificate to document the tax that has been deducted from the employee's salary income. This document serves as evidence that the government has deducted tax from the employee's salary income at the source and deposited it with the government. It is imperative for the purpose of submitting income tax returns.

b) Form 16A is a TDS certificate that is not issued by the employer but rather by financial institutions for income that is not salary. For example, a Form 16A will be provided to you when a bank deducts TDS on your interest income from fixed deposits, for TDS deducted on insurance commission, or for TDS deducted on your rent receipts.

c) Form 16B is a document that is issued to document the deduction of TDS on payments made for the acquisition of property under section 194-IA of the Income Tax Act, 1961. The purchaser of the property is accountable for deducting TDS at a rate of 1% prior to submitting payment to the seller. Consequently, the buyer is required to provide the seller with Form 16B as evidence of TDS deduction.

Anticipated issue date for Form 16 for the fiscal year 2023-24

The deadline for submitting Form 16 is June 15, 2024. Form 16 must be issued by June 15, 2024, if your employer deducted TDS from April 2023 to March 2024. In the event that you misplace your Form 16, you may request a duplicate from your employer.

Eligibility requirements for Form 16

Form 16 is available to all salaried individuals whose income is within the taxable bracket, as per the regulations established by the Finance Ministry of the Indian Government.

An employee will not be required to have Tax Deducted at Source (TDS) if their income does not fall within the established tax brackets. Therefore, the company is not required to provide Form 16 to the employee in these circumstances. Numerous organisations now issue this certificate to employees as a sign of good work ethic. It encompasses a comprehensive overview of the individual's earnings and serves other purposes.

Reasons for the requirement of Form 16

i)Evidence that the government has received the tax that your employer has deducted.

ii) Assists in the filing of your income tax return with the Income Tax Department.

iii) Evidence of Salary Income.

iv) Numerous financial institutions and banks require Form 16 to verify an applicant's credentials when they apply for a loan.

v) Each salaried employee must obtain Form 16 from the employer no later than June 15th. Employers who fail to issue Form 16 by the designated date will be held accountable for a penalty of Rs 100 per day until the default is rectified.

How do I download Form 16 from the income tax portal?

The Income Tax Department of India operates an online website known as TRACES (TDS Reconciliation Analysis and Correction Enabling System). It is employed to oversee TDS-related activities and offers services to employers, taxpayers, and other stakeholders. This platform enables employers to download Form 16 Parts A & B. The following steps should be taken to download Form 16 from TRACES:

i) Step 1: Access the official TRACES website.

ii) Step 2: To log in, enter your PAN card number (User ID) and password if you have already registered. If you are a new user, you must complete the registration process and establish a new account.

iii) Step 3: Select "Form 16" from the "Downloads" tab.

iv) Step 4: Select the form type and the financial year for which Form 16 is necessary.

v) Step 5: Confirm the PAN and other pertinent information.

vi) Step 6: Select the date of the TDS and enter the TDS receipt number.

vii) Step 7: Compute the aggregate amount of tax that has been collected and deducted.

viii) Step 8: To request a download, click on the "submit" button.

ix) Step 9: Once the form is accessible for download, download the files from the 'Downloads' tab.

Points to consider when checking Form 16

i) Upon receiving Form 16 from the employer, it is the individual's responsibility to verify that all information is accurate.

ii) For instance, the amount of income, the amount of TDS deducted, and other details should be verified in Form 16.

iii) If any of the details are inaccurate, it is imperative to promptly contact the organisation's HR/Payroll/Finance department to rectify the situation.

iv) The employer would subsequently rectify their error by submitting a revised TDS return that credits the TDS amount to the appropriate PAN. The employer will provide their employee with an updated Form 16 once the revised TDS return has been processed.

How do I file income tax returns online using Form 16?

i) Use your login credentials to access the website.

ii) Access 'e-File' and select 'Prepare and submit ITR online'.

iii) Choose the appropriate income tax return form and assessment year.

iv) Complete the required information and click the "Submit" button. (There, you would request the upload of all necessary forms, including Form 16).

v) A message will be displayed indicating that the ITR has been submitted and will be processed upon successful submission.

vi) Subsequently, you are required to verify your ITR electronically. There are three methods for e-verifying ITR. If the return is not e-verified, the ITR-V form (password protected) must be printed, signed, and returned to CPC within 120 days of the e-filing date.

Hope you have deduced Form 16 meaning, how to download Form 16 from the income tax website for salaried employees, and how to file income tax returns online using Form 16 from this article!

Frequently Asked Questions

1. How can errors in Form 16 be rectified?

Your employer may rectify any errors in Form 16 on their part upon your request. Your employer will subsequently provide you with a revised Form 16. Please furnish them with the requisite information and documentation to substantiate your assertion. The errors will be rectified, and a revised Form 16 will be issued.

2. I have not received Form 16 from my employer; do I still need to file my income tax return?

Filing an income tax return is mandatory if your gross total income exceeds 2,50,000 INR. The issuance of Form 16 by your employer is contingent upon the deduction of tax from your salary. If your income exceeds the specified limit and your employer does not deduct tax, you are obligated to file your income tax returns, regardless of whether you possess Form 16.

3. Although I have not yet received Form 16, how can I determine my salary income?

To file income tax returns, you will be required to consult your salary payslips, bank statements, tax-saving investment proofs, home loan certificates, education loan certificates, Form 26AS, and other relevant documents if you have not yet received Form 16. Payslips provide information regarding your income, and Form 26AS contains information regarding all taxes deducted and paid.

4. My employer has deducted tax from my salary; however, neither my Form 16 nor my Form 26AS exhibit any such deduction entries. How do I handle this scenario?

In this scenario, it is feasible that your employer has not deposited the tax deducted from your salary into the government account. You are required to pay the full amount of tax when submitting your income tax return. Additionally, you should promptly notify your employer of this issue. In addition, the employee should inform the Jurisdictional A.O., who may take appropriate action.

5. I changed jobs during the year; how should I proceed with filing my ITR?

You will receive Form 16 from each employer for the months you worked there if you had two employers during the year. The details of both Form 16s will be combined to file the income tax return. However, you must exercise caution in doing so, as it is possible that your current and former employers have calculated your tax after considering the basic exemption limit.

6. Will I receive Form 16 from my employer in the event that there is no TDS?

Form 16 is a TDS certificate that is only issued when tax has been deducted. The employer is not obligated to provide you with Form 16 if no tax is deducted. Nevertheless, a significant number of employers, particularly those in the corporate sector, issue Form 16 regardless of whether or not tax deductions have been made.

7. I would like to claim a deduction under Chapter VI-A or other exemptions/allowances in my income tax return that are not included in my Form 16. What’s the process?

The deduction can still be claimed when filing ITR, even if your employer does not provide you with a Form 16 that includes any deductions. Form 16 is a certificate that your employer issues to verify the deduction of tax (TDS) from your salary. You are always entitled to the deductions for which you are eligible when you file your income tax return, regardless of whether they are specified in your Form 16.

8. What information is included in Form 16?

Form 16 contains information regarding salary income, allowances, deductions, and TDS (Tax Deducted at Source). Additionally, it furnishes details regarding the employer's PAN and TAN. Part A includes employer and employee information, and Part B offers a comprehensive overview of your salary, deductions, and taxes.