Exclusive: The saga of United Breweries; from Thomas Leishman to Vijay Mallya and more

United Breweries Limited (UBL) began its storied journey in 1857 when Scotsman Thomas Leishman established a bulk beer production facility in South India.

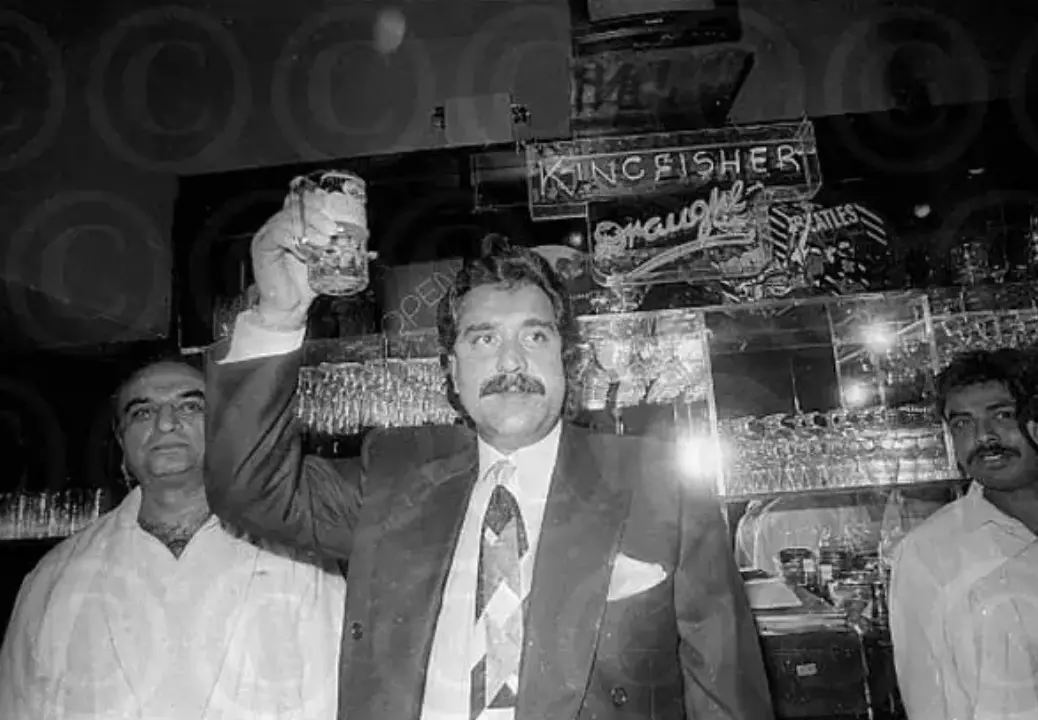

image for illustrative purpose

United Breweries Limited (UBL) began its storied journey in 1857 when Scotsman Thomas Leishman established a bulk beer production facility in South India. The company formally took shape on March 15, 1915, in Madras (now Chennai), with Leishman at the helm as its first Managing Director. Initially, UBL catered to the beer needs of troops during both World Wars, setting a foundation for its future endeavors.

The narrative of UBL took a significant turn in the 1940s with the advent of Vittal Mallya, a visionary leader who joined the Board of Directors in 1947 at the youthful age of 22. His dynamic leadership saw him become Chairman just a year later. Under his stewardship, UBL relocated its Registered Office to Bangalore in June 1952, marking a new era of expansion and diversification.

A pivotal moment in UBL’s history came in 1951 with the creation of McDowell’s, its first subsidiary, marking the company’s entry into the liquor segment. This move positioned UBL as a pioneer in producing Indian Made Foreign Liquor (IMFL), offering indigenous alternatives to foreign brands. Vittal Mallya's strategic vision led to further diversification into sectors like polymers, batteries, pharmaceuticals, and food industries, laying the groundwork for a sprawling conglomerate.

Following Vittal Mallya's demise, his son Vijay Mallya took over as Chairman in 1983 at the age of 28. Vijay Mallya's tenure was marked by bold ventures and ambitious expansions, transforming the UB Group into a multi-industry giant with annual sales exceeding US$4 billion and a market capitalization of approximately US$12 billion.

Under Vijay Mallya, the UB Group launched successful IPOs for its subsidiaries on international stock exchanges, earning global recognition. Notable ventures included Kingfisher Airlines and the acquisition of the Force India Formula One team, showcasing Mallya’s flair for grandeur and diversification.

However, the group’s growth was marred by persistent profitability issues. Despite soaring assets and revenue, the company often reported minimal or negative profits, raising questions about investment strategies, management efficiency, and possible financial maneuvers to avoid dividends and taxes.

One of the most audacious undertakings was Kingfisher Airlines, envisioned to redefine air travel in India with luxury and innovation. Yet, its rapid expansion led to insurmountable debt, culminating in its grounding in 2012 amid a financial crisis. This, along with legal and extradition battles against Vijay Mallya, severely impacted the UB Group’s reputation and stability.

In the wake of Mallya’s departure from India under legal duress, United Breweries faced a turbulent period marked by plummeting share prices and dwindling investor confidence. The Kingfisher brand, once a symbol of luxury, became embroiled in controversy. However, new leadership steered UBL towards a path of reinvention, focusing on regaining trust, enhancing brand value, and stabilizing finances.

Strategic partnerships, innovative marketing, and a renewed commitment to quality enabled United Breweries to navigate through these challenges. Today, UBL stands resilient, a testament to its capacity for adaptation and endurance. The Kingfisher brand, though scarred, remains a symbol of Indian craftsmanship and innovation, embodying a legacy of triumphs and tribulations in the ever-shifting landscape of Indian corporate history.