How is Your Credit Score Calculated?

image for illustrative purpose

Your credit score determines your financial health and creditworthiness. It is a representation of your ability to manage debt and repay loans on time. Lenders such as banks, non-banking financial companies (NBFCs), and credit card issuers refer to your credit score to evaluate your eligibility for loans or credit products.

A higher credit score increases your chances of securing credit at terms which are more favorable, while a lower score can often result in high interest rates or rejection of your application. For instance, Muthoot Finance offers a free credit score check service to help you understand and improve your financial health.

But how is credit score calculated? Your score is determined by various factors, including your payment history, credit utilization, length of credit dues, and more. These factors together combine to form an overall score, which typically ranges between 300 and 900. Let's dive deeper into the components of your credit score and how they impact your financial future.

What is a Credit Score?

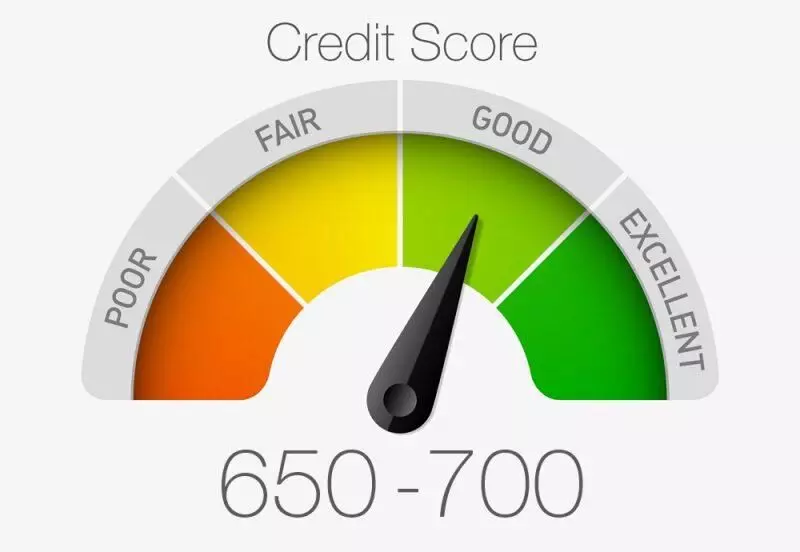

A credit score is a 3 digit numerical figure that symbolises your creditworthiness. It reflects your ability to borrow and repay money responsibly. While different credit bureaus may have slightly varying calculation methods, the score generally falls into these categories:

Score Range Category Meaning

300-550 Very Poor High credit risk; may struggle to get approved for credit.

551-650 Poor Indicates financial mismanagement; improvement needed.

651-750 Good Creditworthy; eligible for loans with reasonable terms.

751-900 Excellent Strong financial history; access to loans with the best interest rates.

For those unfamiliar with their credit score, platforms like Muthoot Finance offer free credit score checks, ensuring you stay informed about your financial standing.

Key Factors That Impact Credit Score

1. Payment History (35%)

Your history of timely repayments is the most significant factor. Late payments, defaults, or settlements negatively affect your credit score. Always ensure that your EMIs, credit card bills, and other dues are paid promptly.

2. Credit Utilization (30%)

This is the percentage of your credit limit used. For example, if your credit card has a limit of ₹1,00,000 and you use ₹40,000, your utilization rate is 40%. Keeping this rate below 30% can positively influence your score.

3. Length of Credit History (15%)

The longer your credit history, the better it is. Lenders value borrowers with an established record of responsible borrowing and repayment.

4. Credit Mix (10%)

A balanced combo of secured loans (like home loans) and unsecured loans (like credit cards) demonstrates financial discipline and contributes positively to your score.

5. Number of Hard Inquiries (10%)

Frequent loan or credit card applications result in hard inquiries by lenders, which can temporarily lower your credit score. Apply for credit judiciously.

How is Credit Score Calculated?

Your credit score is calculated based on the following weighted factors:

Factor Weightage Impact on Score

Payment History 35% Reflects consistency in meeting repayment deadlines.

Credit Utilization 30% Highlights dependency on available credit limits.

Length of Credit History 15% Demonstrates experience in managing credit over time.

Credit Mix 10% Indicates ability to handle different types of credit.

Credit Inquiries 10% Reflects the number of recent credit applications.

Each bureau may tweak these percentages slightly, but the overarching principles remain consistent.

Why Should You Check Your Credit Score?

Regularly monitoring your credit score offers several advantages:

● Identify Errors: Incorrect entries in your credit report can damage your score. Early detection allows for timely rectification.

● Prevent Fraud: Monitoring helps you detect unauthorized credit inquiries or accounts opened in your name.

● Plan Financial Goals: Understanding your score helps you make informed decisions about applying for loans or credit cards.

Muthoot Finance enables individuals to perform a free credit score check, empowering them to monitor and maintain their financial well-being.

Tips to Improve Your Credit Score

1. Pay Bills on Time: Timely repayments are essential. We should set up alarms, reminders or automatic payments to avoid missing deadlines.

2. Reduce Credit Utilization: Keep your credit usage below 30% of the available limit. This signals responsible credit behavior.

3. Limit Credit Applications: Avoid frequent applications for loans or credit cards, as each hard inquiry can lower your score temporarily.

4. Maintain Older Accounts: Retaining older credit accounts adds to your credit history and positively impacts your score.

5. Diversify Credit Types: A mix of secured and unsecured loans demonstrates financial stability and credit management skills.

The Impact of a High Credit Score

Rahul, a 32-year-old marketing professional, was eager to purchase his first home in a bustling metro city. However, his financial journey had been far from smooth. A few years back, he had accumulated significant credit card debt due to unplanned expenses and delays in repayment. These financial missteps had brought his credit score down to 650, a point where lenders considered him a high-risk borrower.

Despite earning a stable income, Rahul faced difficulties in getting a loan approved, and when approvals came through, the offered interest rates were exceedingly high, adding to his financial stress.

Determined to turn his situation around, Rahul decided to take control of his finances and improve his creditworthiness. He started by seeking guidance on how credit scores work and came across Muthoot Finance’s free credit score check service, which provided him with actionable insights. Leveraging this tool, Rahul developed a strategic plan to rebuild his credit score.

He began making timely payments on his existing dues, significantly reduced his credit card usage to below 30% of his limit, and avoided applying for new credit unnecessarily. Additionally, he diligently monitored his credit report every month to ensure there were no errors or discrepancies that could impact his score.

Within a year of disciplined effort, Rahul’s credit score soared to an impressive 780. This transformation not only opened doors to multiple loan options but also secured him a home loan at an interest rate lower than what was initially offered.

Over the tenure of his loan, this reduced rate translated into substantial savings, reinforcing the importance of maintaining a good credit score.

Rahul's journey serves as a testament to how proactive financial planning and using the right tools can lead to significant long-term benefits. With Muthoot Finance’s support, he achieved his dream of owning a home, while also ensuring a more stable financial future.

Understanding how credit score is calculated and proactively taking measures to maintain or improve it can significantly enhance your financial opportunities. Regular credit score checks, like those offered by Muthoot Finance, ensure you remain informed and empowered to make sound financial decisions. Take charge of your financial health today—your future self will thank you!