Understanding and Comparing Demat Account Brokerage Charges

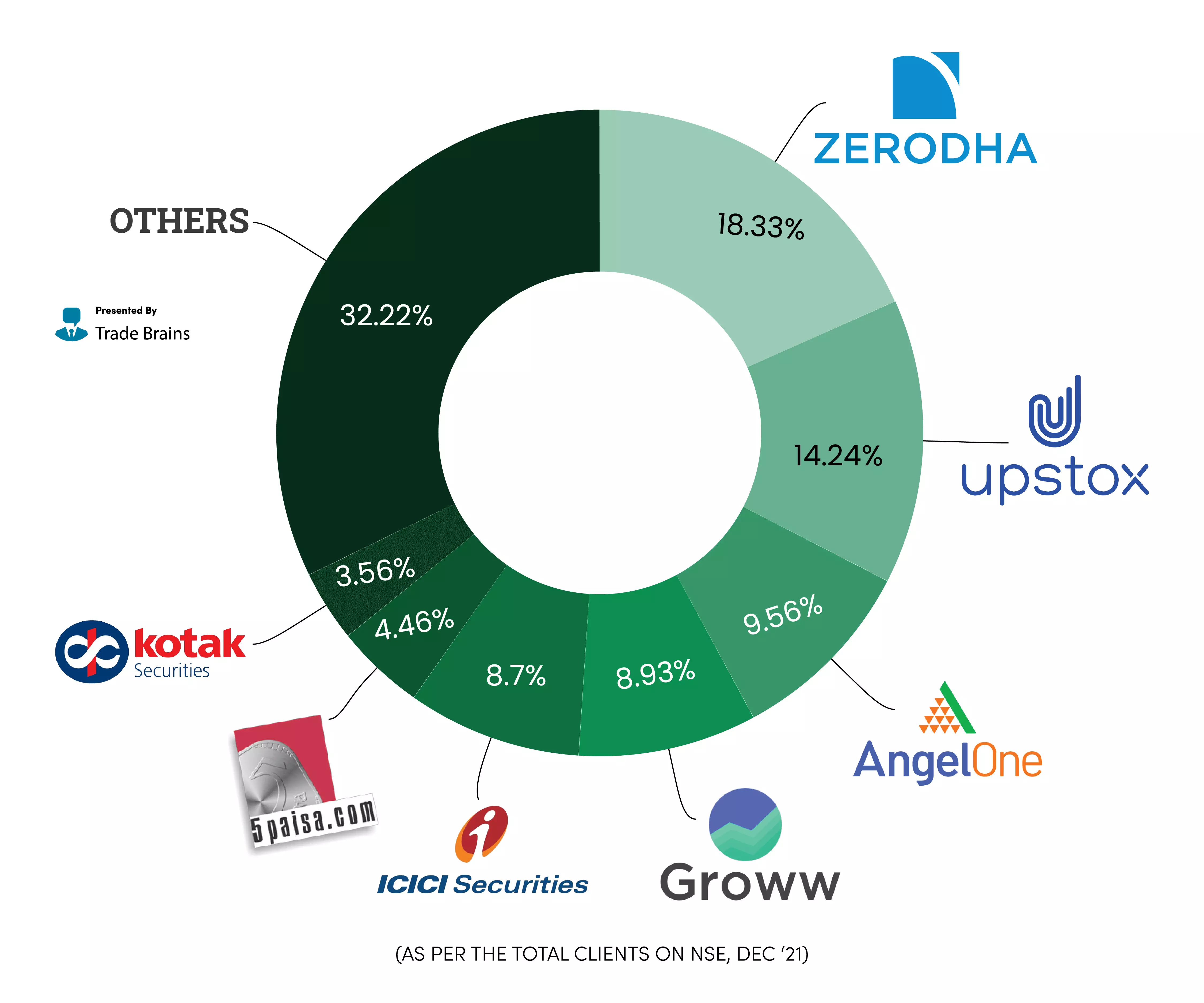

image for illustrative purpose

Introduction

Demat account brokerage charges pave the way for a significant part of the trading and investing arena. This favours investors to take into account these fees because they have a direct impact on the trade profitability of investors. This article will dive into the intricate details of demat account brokerage charges, compare different brokerage models, and give advice on how investors can make choices that will help them make better decisions based on all the evidence.

What are Demat Account Brokerage Charges?

Demat account brokerage charges are the name of the transaction fees charged by brokerage firms to manage transactions and financial activities in the stock exchanges. These charges have for instance brokerage fees, transaction charges, account maintenance fees, and taxes that are part of it.

1. Brokerage Fees:

Brokerage fees account for the main amount to be paid for owning a demat account. It is a commission that brokers are to be paid when an investor gets a buy or sell order executed on their behalf. The brokerage fee is obtained by calculating the percentage of the transaction value or by using a fixed amount for each trade. Investors should check different broker fee options to opt for the cheapest one.

2. Transaction Charges:

Alongside these brokerage fees, investors might also be subject to fees charged by stock exchanges and authority bodies. They rely on the transaction value and type of security traded prices. There are trading charges for purchasing and selling securities which may lead to a big amount of initial trading costs.

3. Account Maintenance Fees:

Some broking firms may charge you an account maintenance fee, which is to support the maintenance of demat accounts. These can be presented annually or per quarter. The investors must watch out for the account maintenance charges levied by brokers, especially the ones with multiple demat accounts, to try and avoid operational costs that could be running them out of business.

4. Taxes:

The taxes investors have to pay as a result of their trading activities comprise the Securities Transaction Tax (STT), GST, and also stamp duty. These taxes are imposed by the government and are significant elements of demat account-away charges. Investors need to include tax implications in the overall cost-benefit analysis of the trade while evaluating the trade.

Comparing Different Brokerage Models

Now that we have discussed the components of demat account brokerage charges, let's compare different brokerage models to understand their pros and cons.

1. Full-Service Brokers

Full-service brokers, give their clients access to a comprehensive set of services, including in-depth research, advice, and management of the client's portfolio. They however levy higher trading commissions than discount brokers but offer investors more value-added services. Full-service brokers would be the right fit for investors who need both guiding as well as personalized support by hand through their investment process.

2. Discount Brokers:

Discount brokers, on the other hand, are the other category that primarily focus on providing low-cost trading solutions with few frills. Due to the lowest brokerage charge compared to full-service brokers, they provide minimal research or advisory support. Discount brokers attract cost-minded traders who want to perform trades themselves independently without any other extras.

Factors to Consider While Choosing the Best Demat Trading Account

When selecting the best demat trading account, investors should consider the following factors:

1. Cost-Efficiency: Analyze the prices which have brokerage fees, transaction charges, and account maintenance fees to check the efficiency of the trading account.

2. Service Offering: Decide if you need extra services specifying you need our research reports, advice or portfolio management. Choose a broker that matches your specific wants and needs.

3. Technology and Platform: Consider the trading platform of the broker, namely its user interface, speediness, steadiness, and versatility of devices. A fast-performing trading platform is the basis of an excellent trading experience and efficiency.

4. Customer Support: As regards the quality of customer support offered by the broker (the response time, availability and query resolution), this factor needs to fall short. Effective customer service ensures the smooth operation of the customer transactions.

5. Reputation and Reliability: Sift through the reputation and reliability of the broker on the market by conducting research. Look for customer reviews, refer to friends and verify the veracity of the broker's credentials to make sure of its trustworthiness.

Conclusion

Most importantly, demat account brokerage fees do matter when you take into consideration the context of share market trading and investment. The brokers charge different tariffs that fall into three categories, such brokerage fees, transaction charges, account maintenance fees, and taxes. Through understanding these features and closely analyzing various models of the brokerage firm, investors are equipped with the tools to make a definite pick of the demat trading account that suits them best.

Knowing the specifics of the brokerage charges is important since this factors in the success of the trade, which determines if any profit can be made. With brokers' commissions, transaction charges, maintenance fees, and taxes involved in the process, the entire expense of trading increases. Thus, through such inspection of the fees traded at different brokers, investors can spot less expensive alternatives appropriate for their investment goals.

Among brokerage models to be considered, investors need to take into account the respective strengths and weaknesses of full-service brokers and discount brokers. While full-service brokers provide comprehensive support and greater personal attention their charges tend to be higher. Brokers offer on-hand discount services that may be very economical for the traders while on the other hand can lack in-depth research and advice. Investors should consider their specific needs and tastes to ensure they choose the best brokerage model to meet their requirements.

Certain factors have to be considered before selecting the best demat trading account. Investor needs to be cost-efficient. Investors should always review their brokerage fees, trading charges, and account maintenance fees to make sure to keep trading costs minimal. On top of that, by cherry-picking the services provided, technology, service and reliability the investors are clued into a convenient and well-organized trading experience. By considering these factors first, investors can use their trading tools optimally to ensure that they are consistently reaping maximum profits on their investments.

Finally, the main principle of my studying demat account brokerage charges is rigour and an attentive approach. By understanding the intricacies of brokerage charges, comparing different brokerage models, and considering essential factors, investors can make informed decisions that align with their financial goals and aspirations in the dynamic world of stock market trading.